Will Xi Jinping’s Speech Aid or Inflame Tensions Between US and China?

US equity markets are expected to open almost 1% higher on Monday, paring another substantial day of losses on Friday as the trade conflict between the US and China ramped up.

Whether the moves we’re seeing at the start of the week in Asia and Europe – and in US futures – reflect optimism that a solution will be found or are simply a case of profit taking on Friday’s moves isn’t clear but a speech from Chinese President Xi Jinping scheduled for Tuesday may point towards the former. China has been gradually opening up its markets for a long time now and there is a hope that Tuesday’s speech may contain some commitments that will help kick start negotiations between the world’s two largest economies.

The message from Larry Kudlow and Peter Navarro – White House Senior Economic Advisor and Director of the White House National Trade Council, respectively – in recent days has been that, while US President Donald Trump is willing to embark on tariffs, he is open to negotiations in order to avoid this. This very much supports the view that this is simply a tactic to get China to the negotiating table and perhaps we can start to see less confrontational talk and more willingness to find a diplomatic solution.

This makes Xi’s speech on Tuesday one of, if not the, most important event for markets this week. Many expect announcements on further opening of the Chinese economy, the question is how far he’ll go and whether it will be enough to satisfy the US administration, at least to the point that it takes on a less provocative approach. Any indication that this is the case could provide some reprieve for markets and lift investor sentiment.

Trade Spat Fallout To Direct Markets

Earnings Season and FOMC Minutes Key This Week

The start of the week at least is likely to centre around trade in the absence of any other events. First quarter earnings season kicks off later in the week which will be of keen interest to investors as we get insight into what impact tax reforms have had on the bottom line, as well as how companies have fared at the start of the year.

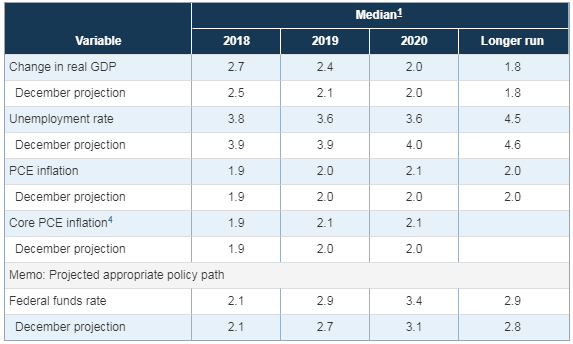

The other event of note this week will be the Federal Reserve minutes on Wednesday. The central bank released new economic projections in March which including upward revisions to growth this year and next, slightly higher inflation and, most importantly, an additional rate hike next year and higher again in 2020.

Federal Reserve Economic Projections (March 2018)

Source – Federal Reserve

The revision comes in response to Trump’s tax reforms which passed at the end of 2017 and will provide an additional stimulus for an economy that is already performing quite well. It will be interesting to get a sense of how close policy makers were to bringing forward an extra rate hike to this year and what it will take for this to change in June.

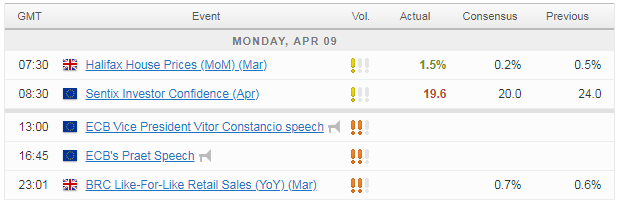

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.