Powell Appearance Eyed For Interest Rate Clues

US futures are slightly in the red ahead of the open on Tuesday as traders adopt a cautious approach ahead of Jerome Powell’s first appearance as Chairman of the Federal Reserve.

Twice a year the Fed Chair appears before the House Financial Services Committee and the Senate Banking Committee to discuss the semi-annual monetary report, events that often draw a lot of attention for obvious reasons. With Powell having just replaced Janet Yellen as head of the central bank – and not even led a meeting at this stage – today’s hearing will likely attract heightened attention as traders look for clues on the direction that he plans to take it.

The feeling so far is that Powell is unlikely to diverge from the current path which would imply three rate hikes this year but with the economy strengthening and tax reform potentially providing additional stimulus, a fourth hike may be warranted this year and along with additional increases further down the road. The market seems quite well positioned on this at the moment which may reduce the likelihood of significant shocks, although we’ve seen how vulnerable markets have shown themselves to be in recent weeks.

Will Dollar Rally or Fade on Fed Powell’s Comments?

Data Takes Back Seat to Powell Testimony

With the event being largely unscripted and markets remaining a little on edge, there is the potential for plenty of volatility throughout today’s and Thursday’s sessions, all the more reason why Powell may well refrain from saying anything that could have adverse consequences on his debut appearance.

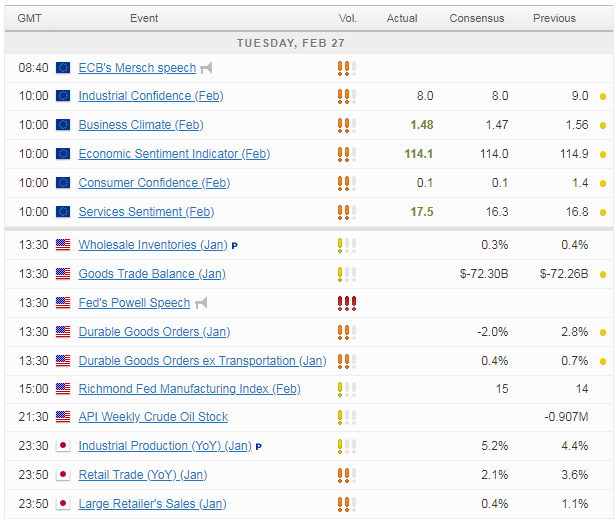

There is also some economic data being released today, although it will likely be largely overshadowed by the Powell testimony. Durable goods orders will be released around the start of Powell’s appearance, along with trade and inventories data. This will be followed shortly after the open by CB consumer confidence data and the Richmond manufacturing index.

$12,000 Key For Bitcoin

It’s been a relatively quiet session so far in Europe with no major economic data leaving markets trading mostly flat. Even bitcoin is having a quiet day so far by its own standard, with the cryptocurrency trading a couple of percent higher on the day and back above $10,000. Bitcoin rallied close to $12,000 last week before stalling and paring gains, having run into resistance around what was an equally tough hurdle in the second half of January.

Bitcoin (CME) Daily Chart

Source – Thomson Reuters Eikon

On that occasion, the level proved too strong and prices fell back towards $6,000 shortly after. Whether it breaks above here on this occasion may be a good indicator of whether bitcoin has in fact bottomed, at which point it will be interesting to see how long it takes to reach its December peak in the absence of the euphoria that aided it last time around.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.