Stocks Remain Vulnerable to Downside Shocks

The rebound in equity markets appears to have lost some momentum, with European stocks trading in the red again on Thursday and US futures flat ahead of the open.

US stock markets have recovered quite well after falling more than 10% a couple of weeks ago but the recovery appears to have stalled in recent days. Around two thirds of the losses had been recovered by Tuesday but a couple of negative sessions has left indices more than 5% off their highs and with more work to do. Indices still appear vulnerable to further shocks and the prospect of more aggressive tightening by the Fed may trigger it.

The minutes from the January meeting, like the statement that accompanied it, were quite hawkish and pointed to at least three rate hikes this year. While this is now strongly priced in – more than 50% – there is potential for a fourth and more again next year, something that appears to be worrying investors and shaking confidence in equity markets.

CME Group FedWatch Tool

Source – CME Group

Sterling Lower After Mixed GDP Data

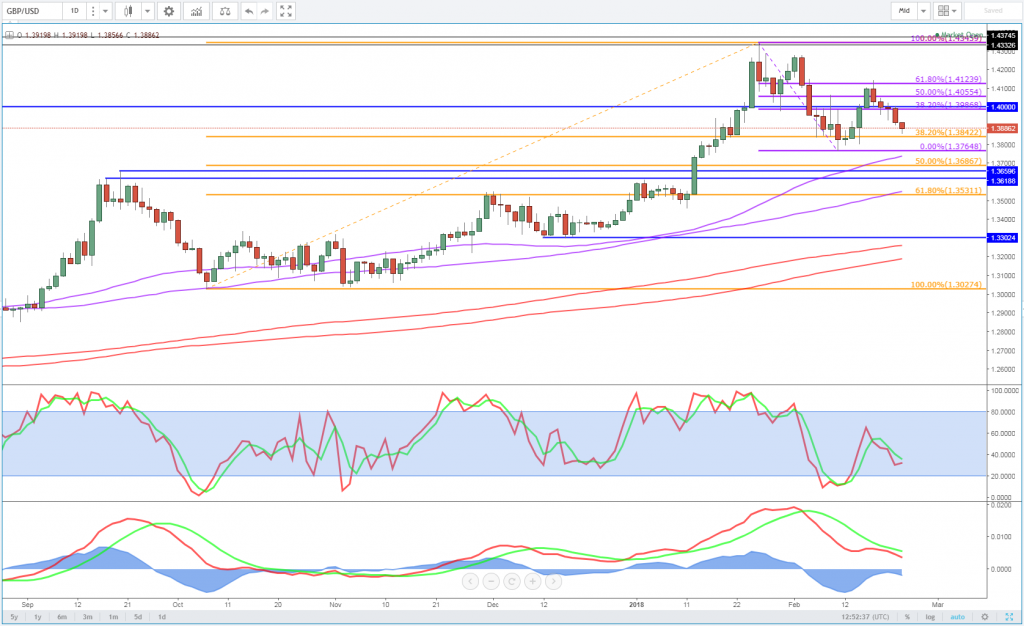

There was some disappointing data from the UK this morning, as growth figures for the fourth quarter were revised down to 0.4% on a quarterly basis and 1.4% on an annual basis. The data triggered some volatility in the pound which is once again lower on the day against the dollar, euro and yen, despite the Bank of England’s clear desire to continue raising interest rates.

The pound has performed very well in recent months as Brexit negotiations moved on to phase 2 and the central bank raised interest rates and signalled an intention to continue to do so gradually. Policy makers certainly struck a hawkish tone in yesterday’s inflation report hearing, although that did little to support sterling which would suggest this has now been priced in. With negotiations over the transition period likely to dominate the next month, the pound could be vulnerable to downside shocks if talks risk breaking down, something that will likely play on the mind of traders.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Dollar maintains its firmer tone

Bitcoin Sell-Off May Not Be Over

Bitcoin continues to be a volatile as ever, having almost double in price in two weeks since bottoming around $6,000 on 6 February. It now finds itself testing $10,000 from above, a level that is providing some support in the near term. Sentiment remains extremely fragile in cryptocurrencies and I’m not convinced it’s yet recovered from what was a nasty sell-off around the turn of the year.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

A break back above $12,000 would suggest that confidence is returning to the space but I would expect any upside gains to be more gradual than we saw last year. The euphoria that accompanied last year’s gains has subsided quite a bit and traders are likely to approach this a lot more cautiously, with many having been burned during the decline.

EUR/USD – Euro Trading Sideways, Investors Eye ECB Minutes

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.