Indices Remain Near Record Highs as US Government Shutdown Ends, For Now

US futures have turned lower ahead of the open on Tuesday having earlier been indicating a higher open on Wall Street. Dow futures had been pointing to a more than 60 point gain prior to the 100 point drop. Still, futures are now only marginally lower and come following new records being set on Monday.

Monday’s gains came as the government shutdown came to an end after only three days, two of which occured over the weekend. A spending bill passed through the Senate and the House on Monday which will enable furloughed workers to return to work, albeit temporarily, giving officials another couple of weeks to find a longer term solution. With Senate Republicans and Democrats seemingly no closer to an agreement on core immigration issues though, there’s a good chance that we’ll be back to square one on 8 February.

While markets were given a small boost as it became clear that the bill would pass through the Senate, there was never any real fear that a continued slowdown would have any significant negative impact on the economy. That has been the experience previously, although the country has never experienced a long shutdown that may bring more significant consequences.

Tuesday is looking a little quiet on the economic data side, with eurozone consumer sentiment the only notable release. From a US perspective, there’ll be more attention on earnings with 16 S&P 500 companies reporting on the fourth quarter including three from the Dow 30. It’s been a good start to earnings season, with those that have already reported having broadly speaking lived up to high expectations.

EUR/USD – Euro Shrugs off Sharp German, Euro Confidence Reports

JPY Higher as BoJ Leaves Monetary Policy Unchanged

The Bank of Japan monetary policy announcement went largely as expected overnight, with the central bank making no changes while downplaying small variants in purchases each month. It also stressed its commitment to maintaining its policy of keeping the 10-year yields around 0% until inflation returns to target, which it’s far from doing now.

10-Year JGB Yield Daily Chart

Source – Thomson Reuters Eikon

At the same time, it did sound a little more upbeat than previously on inflation expectations which appears to have lifted the yen, with the dollar down around half a percent, the euro a little more and the pound more again. I’m not convinced we can read too much into this though with expectations still very low and unlikely to rise to target any time soon.

Bitcoin Eyeing Sub-$10,000 as Sell-Off Continues

Bitcoin is trading in the red for a third session and is threatening to break back below $10,000 again today, having done so last Wednesday for the first time since the start of December. It would appear that despite losing half its value since peaking on 17 December, the rout may not be over. It’s not just bitcoin that’s having a bad day, similar losses are being seen throughout the cryptocurrency space with speculators clearly not as keen to buy the dips as they were in early December.

Central Banks Dictate FX Moves while Stocks Rock

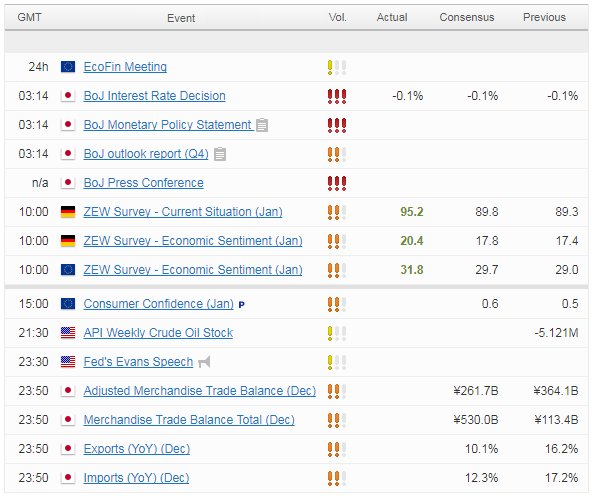

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.