Equities, Bonds and USD Slide as China Questions Attractiveness of Treasuries

US futures are coming under pressure ahead of the open on Wednesday, following reports from a Chinese official that the country is considering cutting or halting its purchases of US Treasuries.

If the reports turn out to be true and China no longer sees Treasuries as an attractive option, the repercussions could be significant as the country is one of the biggest holders of US debt. A significant change in policy could put considerable upside pressure on US yields, the result of which would be an effective tightening for the US. US 10-year yields spiked on the reports but have since settled and are up around three basis points on the day, having already risen in line with other countries yields on Tuesday.

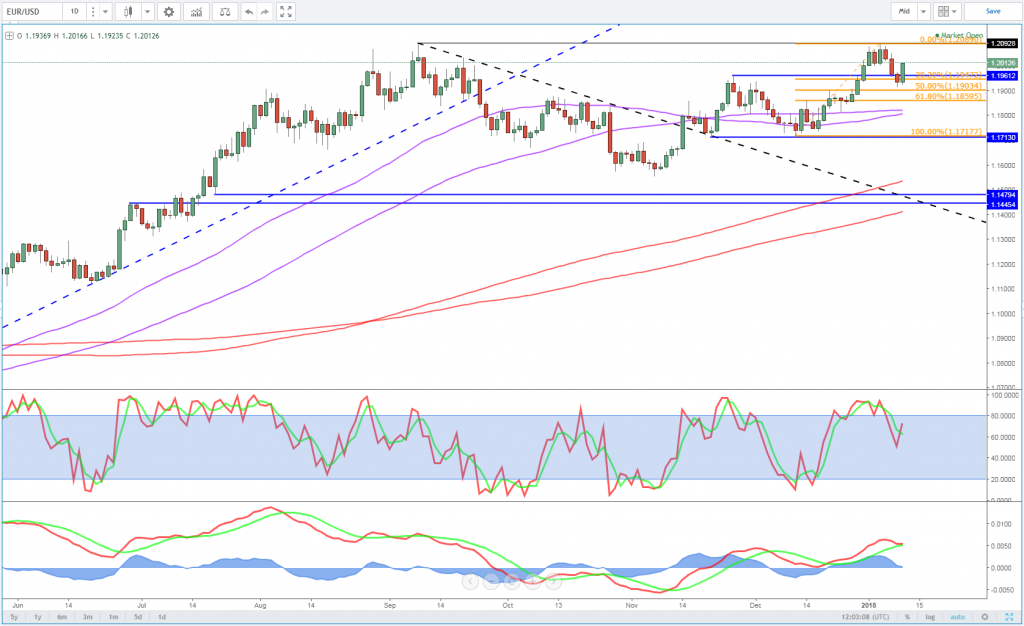

The tightening effect of such measures would likely have an impact on how many times the Federal Reserve raises interest rates this year, which is why we’ve seen a corresponding drop in the dollar. The euro has spiked back above 1.20 against the dollar on the back of the reports before settling just below, while cable has moved back into the green on the day having been down around half a percent earlier in the session.

OANDA fxTrade Advanced Charting Platform

Yields Rise For Second Day as BoJ Move Provides Additional Upward Pressure

The move in Treasuries comes a day after yields generally rose on Tuesday in response to the Bank of Japan buying slightly fewer long-term JGBs, which traders took as a sign that the central bank is preparing to take its foot off the easing gas. While the BoJ has repeatedly rejected speculation that its preparing to reduce its accommodation, there was a lot of talk towards the back end of last year that it was being considered and that’s why traders have been so quick to jump on it.

US 10-Year Treasury Yields

Source – Thomson Reuters Eikon

Follow the Yield, and Then Follow the Currency

Oil Spikes on API Report as Traders Eye EIA Release

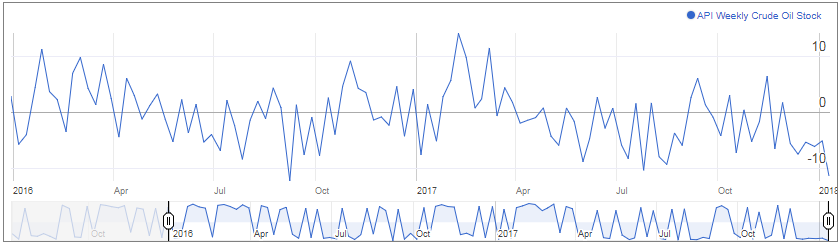

Oil is trading higher for a second day after surging to fresh 3-year highs on Tuesday, as API reported a huge decline in inventories last week, the biggest drop since September 2016. EIA will release its inventory data on Wednesday and its release typically carries more weight than the API number. Should EIA report a similar figure to API, it could trigger another push higher in oil – with markets previously anticipating only a 3.89 million barrel drawdown – while a smaller number may see it pare its gains.

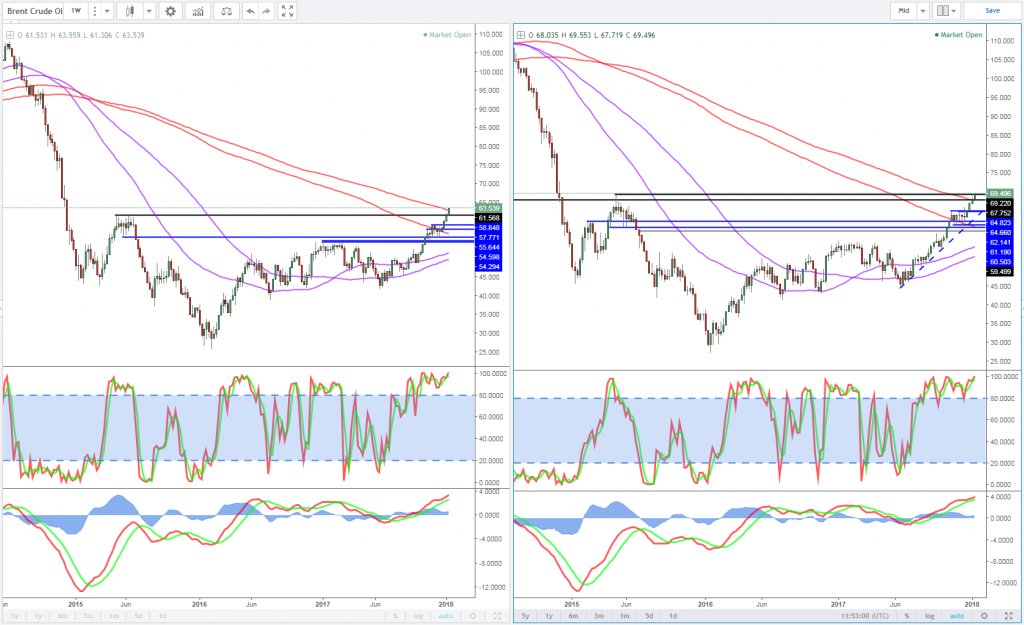

API Weekly Crude Oil Stocks

Oil has already made substantial gains over the course of the last six months – with both Brent and WTI crude up just shy of 50% from their June lows – driven primarily by the agreement to cut production between OPEC and some non-OPEC countries, including Saudi Arabia and Russia. While some doubted whether the countries would follow through on the deal and how effective it would be, the results are clear for all to see with oil now trading back at more sustainable levels, despite US output continuing to rise. I do wonder how much more upside we’ll see though before countries involved in the deal either reduce the size of the cuts or end them altogether.

WTI and Brent Crude Daily Charts

EUR/USD – Euro Reverses Slide, Climbs to 1.20

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.