Earnings, Retail Sales and Inflation Eyed on Friday

US futures are trading a little flat once again ahead of the open on Tuesday, potentially a sign that markets have entered wait and see mode ahead of the start of earnings season.

Friday marks the unofficial start of earnings season and given the relative lack of notable economic events at the start of the week, it’s not surprising to see little movement so far. Equity markets in the US are trading at record highs and with high expectations for earnings season already baked in, there may be an element of caution among investors who will be eagerly anticipating the first batch of results.

Of the economic reports being released this week, the two that stand out are inflation and retail sales figures for December, both of which provide important insight into the US economy. At a time when questions are being asked about whether the Federal Reserve should be pursuing such aggressive tightening, these numbers are very important in determining whether such a move is warranted or should be halted.

EUR/USD – Euro Dips Despite Sharp German Numbers

Nine Year Low in Unemployment Does Little to Lift the Euro

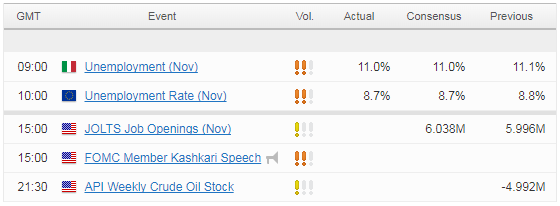

It’s been a relatively quiet morning in Europe on the economic data side as well, with only low tier figures being released. Of those released, the one that stands out was the eurozone unemployment release for November, which fell to 8.7 – the lowest since January 2009 – in line with expectations. This further supports the view that significant progress is being made in the region, although as ever the benefits are not even with some countries in the periphery still seeing very high jobless numbers. Italy, for example, saw unemployment fall to 11%, its lowest since late 2012.

Eurozone Unemployment

The drop in unemployment did nothing to lift the euro, which continued to slide against the dollar, pound and yen. The euro had been on an impressive run up until the end of last week but it appears to have run out of steam just shy of September’s highs against the greenback. It’s off almost 1.5% from last week’s highs but may find some support around 1.19 – 1.1850.

Dollar bears got too far over their skis

Bitcoin Struggling Again After Modest Late Monday Recovery

Bitcoin continues to be as volatile as ever. After suffering substantial losses on Monday – down close to 15% at one point – Bitcoin did make a modest recovery late in the day but that appears to have been short-lived. It’s trading down around 2% currently on the day and I wonder whether the sell-off over the festive period has knocked speculators confidence in it to make the kind of recoveries we saw at times last year.

Bitcoin Daily Chart

Source – Thomson Reuters Eikon

The inability to make these kinds of recoveries may just be temporary and a period of stability may be sufficient to draw traders back in but I wonder whether another correction may take place before that happens. Bitcoin may have gone through a large correction over the last month but even that only represented about half the huge rise between mid-November and mid-December. Should it survive a couple more weeks without any scares then I think we could see appetite for Bitcoin return.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.