Revised UK GDP Figures Eyed as OBR Lowers Forecasts

The ONS will release second quarter GDP data for the UK this morning, which is expected to be unrevised from last month’s preliminary reading of 1.5%. If the OBR’s forecasts – as revealed by Chancellor Philip Hammond in yesterday’s Autumn – are to be believed, we should get used to only moderate growth in the coming years, with significant downward revisions being driven by lower productivity and business investment.

TransCanada Wishes It Was 24 Hours From Tulsa, Not South Dakota

DAX Set to Underperform Again as Political Uncertainty Weighs

European equity markets are poised to open a little lower on Thursday, with the DAX underperforming its peers as political uncertainty weighs on the German index.

Germany has been the one area of stability in the eurozone since the global financial crisis, even when the region appeared on the brink of collapse but it would appear it has come at a cost. Chancellor Angela Merkel has been striving to form a “Jamaica coalition” with the Greens and the FDP since the election but this appeared to fall apart at the weekend.

The SPD has insisted that it would prefer to go into opposition rather than form another grand coalition with Merkel’s party, with the previous partnership appearing to have come at a political cost. This leaves Merkel with few options in the absence of a change of heart from the other parties, increasing the probability of another election and more uncertainty. This appeared to weigh on the DAX late on Wednesday and looks to be doing the same ahead of the open this morning.

OANDA fxTrade Advanced Charting Platform

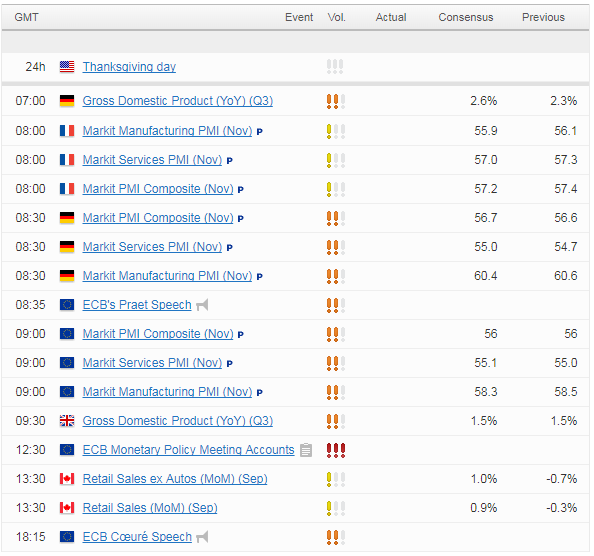

While the European session itself won’t be particularly quiet with plenty of economic data being released throughout the morning, the Thanksgiving holiday in the US will likely have a significant impact on trading volumes and make for a quieter afternoon session.

ECB Accounts and Eurozone PMIs Also in Focus

We’ll also get manufacturing and services PMIs this morning from the eurozone, Germany and France, as well as the accounts from the last ECB meeting, at which policy makers agreed to halve and extend the asset purchase program by nine months. I don’t expect much from the minutes though as the move was fully priced in at the time and there’s unlikely to be significant clues about the next step, even if it would currently appear to be quite obvious.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.