Oil and Gold mark time in Asia as the technicals suggest both asset classes are starting to look a little tired.

Oil

Oil had a lethargic look about it overnight with both contracts trading in a one percent range but finishing unchanged from the day before. The Crude Inventories came in at a more substantial than expected -5.7 million barrel drop and various OPEC “sources” said the grouping was leaning towards a nine-month extension until the end of 2018. None of this managed to spark much life into traders though.

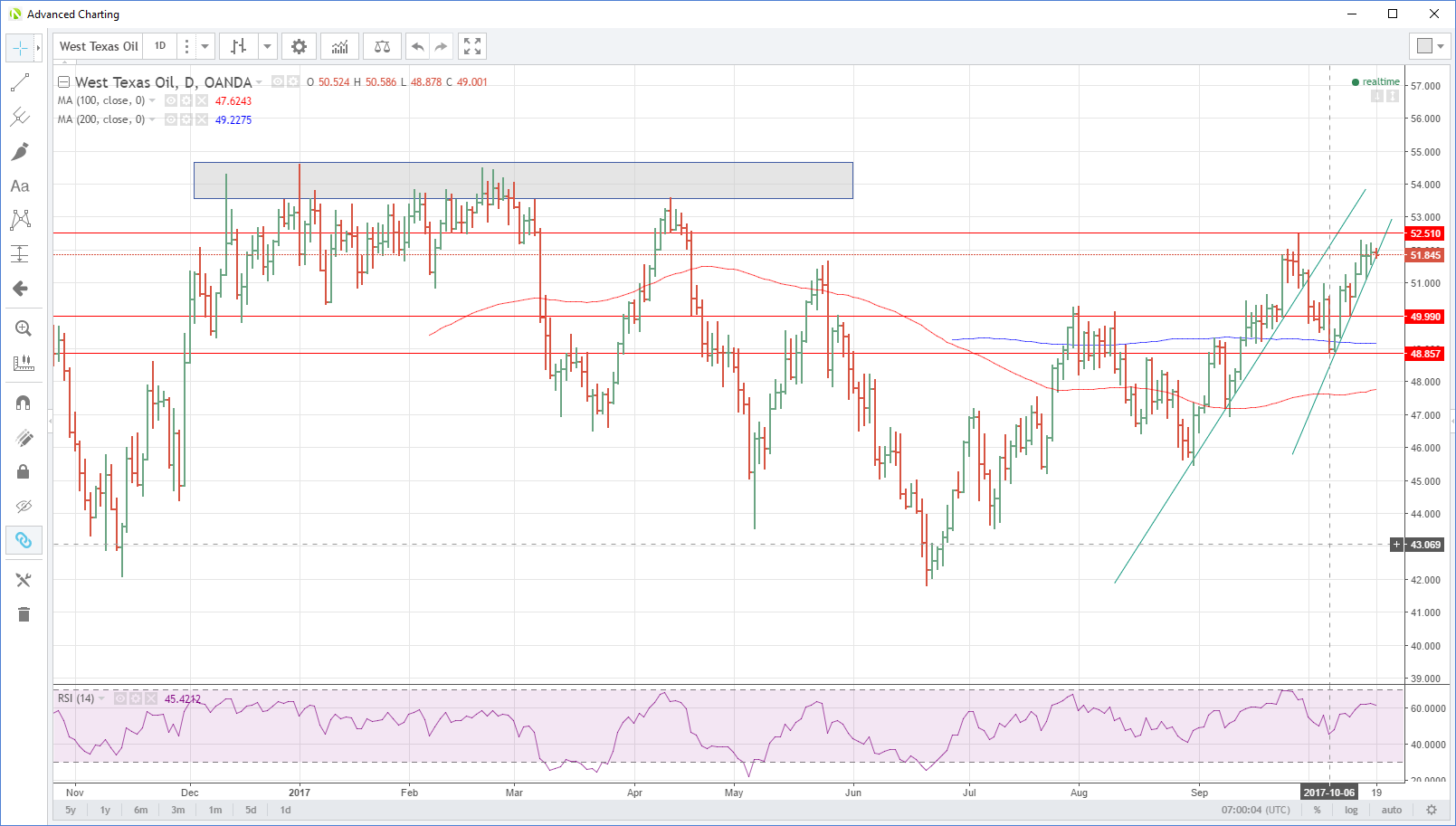

Both Brent and WTI continue to look constructive on the charts. However, rising support lines on both are now almost at the market, suggesting that both may soon be vulnerable to a short-term correction if broken. The street is looking for new inputs to reinvigorate the rallies, and one suspects that at these levels, both contracts are running into substantial shale producer heading via selling in the futures.

Brent is trading unchanged at 58.30 in Asia with resistance at 58.65 and then 59.10 with the latter level proving formidable. Below, the short-term support line comes in at 57.60 today followed by a double bottom at 57.20. Brents long-term support line now sits at 55.10 which is also the October low.

WTI is trading at 52.00 with resistance at 52.50 ahead of its long-term resistance region between 53.50 and 54.50. It seems reluctant to test 52.50, having flirted with it all week, suggesting that producer hedging is capping gains even as the inventory data should have been positive for prices. The short-term support line is immediately below at 51.85 with a break suggesting a move to 51.00 initially. If this level were to give way, WTI would then be set for a retest of the pivotal 50.00 a barrel mark.

Gold

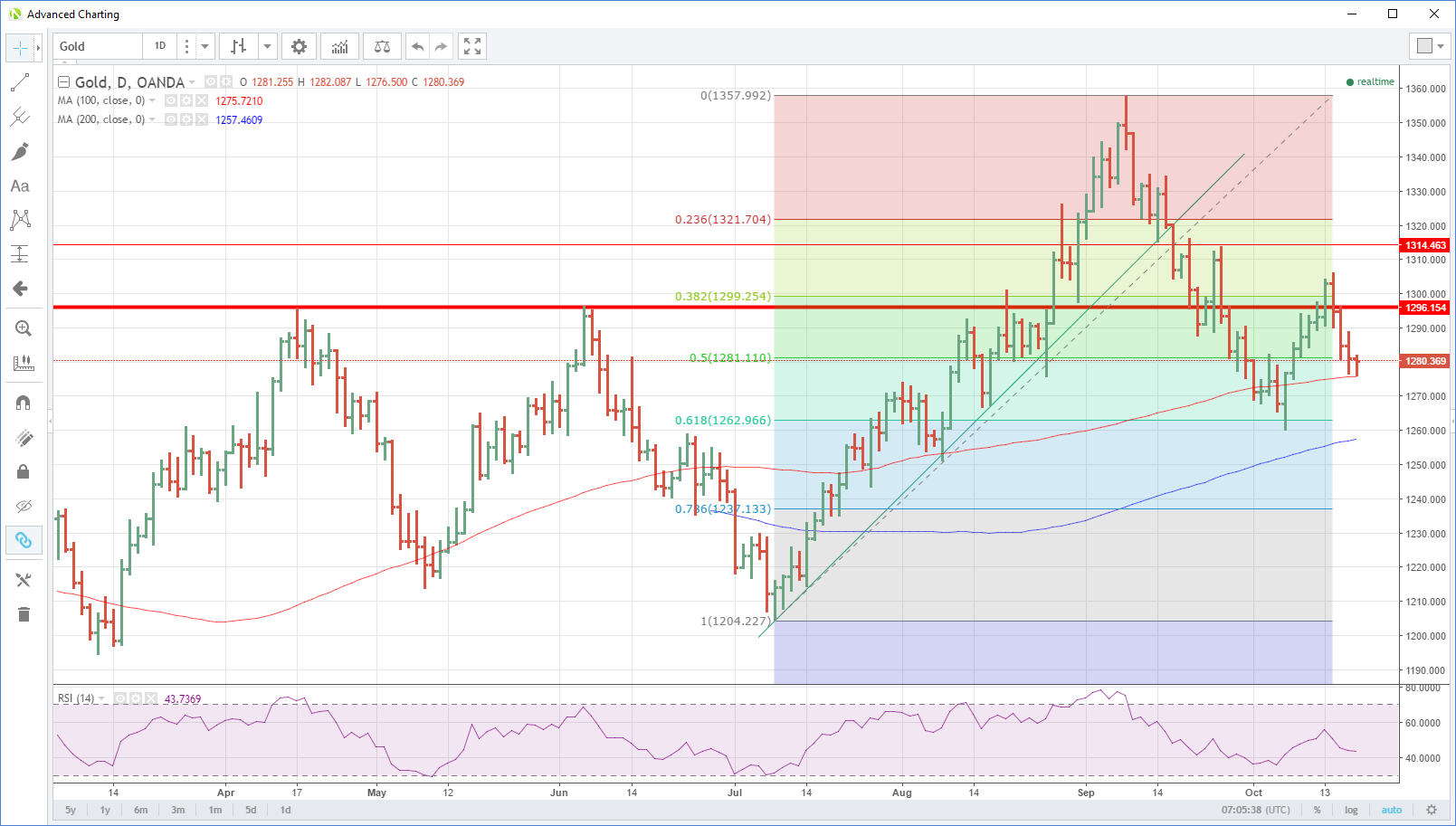

Gold traded in a noisy 12 dollar range overnight, but that’s all it was, noise, as it settled at the end of the New York session a few dollars lower than the previous day at 1281.25. The fact that the dollar index was actually slightly lower overnight will be of concern to gold bulls with gold setting a series of lower daily highs over the week and unable to sustain rallies on dollar index weakness.

Perhaps the only positive is that gold held its 100-day mo0ving average at 1275.70 overnight with this level now a critical intra-day pivot. A break lower would open a retest of the 61.80% retracement at 1263.00 and then October’s low at 1260.60.

Gold itself is unchanged in moribund Asian trading this morning with resistance at the overnight high at 1289.00 followed by 1296.00.

With U.S. yields continuing to creep slowly higher and stocks markets riding exuberantly high it will most likely take some sort of geopolitical event to break the yellow metal out of its bearish malaise.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.