We’re seeing risk aversion in the markets again on Friday, with the possibility of a self-inflicted crisis within Donald Trump’s White House and another terror attack, this time in Barcelona, weighing on risk appetite.

Cohn Resignation Would Cap Off a Dreadful Week For Trump

Trump has been no stranger to controversy in his short time as President but the latest entirely unnecessary and avoidable situation could prove quite costly for him. Trump has already this week been forced to dissolve his manufacturing council and the strategic and policy forum, while his infrastructure council never even got off the ground, after numerous CEO’s withdrew from the initiatives due to his response to the white supremacy rally in Charlottesville, Virginia, last weekend.

Washington’s House of Cards has Dollar on the Defence

The next casualty could be the most costly of the lot, with speculation growing that Gary Cohn – a key figurehead in Trump’s tax reform and spending initiatives – could resign from his position as National Economic Council Director. This would be a bitter blow for Trump and be the icing on the cake of what has been a dreadful week for the President. The negativity is flowing through to the markets as well as such a move would cast doubt over whether Trump will deliver on his tax reform and spending promises in the foreseeable future, two things that have been at least partly responsible for the post-election rally in the markets.

Gold Could Breach $1,300 if Cohn Resigns

The traditional safe havens are once again being preferred today, with Gold up half a percent to trade close to $1,300 once again. It seems there’s a number of factors driving the bullish case for Gold at the moment – a weak dollar, US political risk, geopolitical risk – and a Gary Cohn resignation could be the straw that breaks the camels back and drives it through $1,300. Gold has already hit a 9 month high today but a break through $1,300 could trigger much bigger gains, with $1,340 potentially offering the next test.

OANDA fxTrade Advanced Charting Platform

USD Softening as Traders Bet Against Another Rate Hike

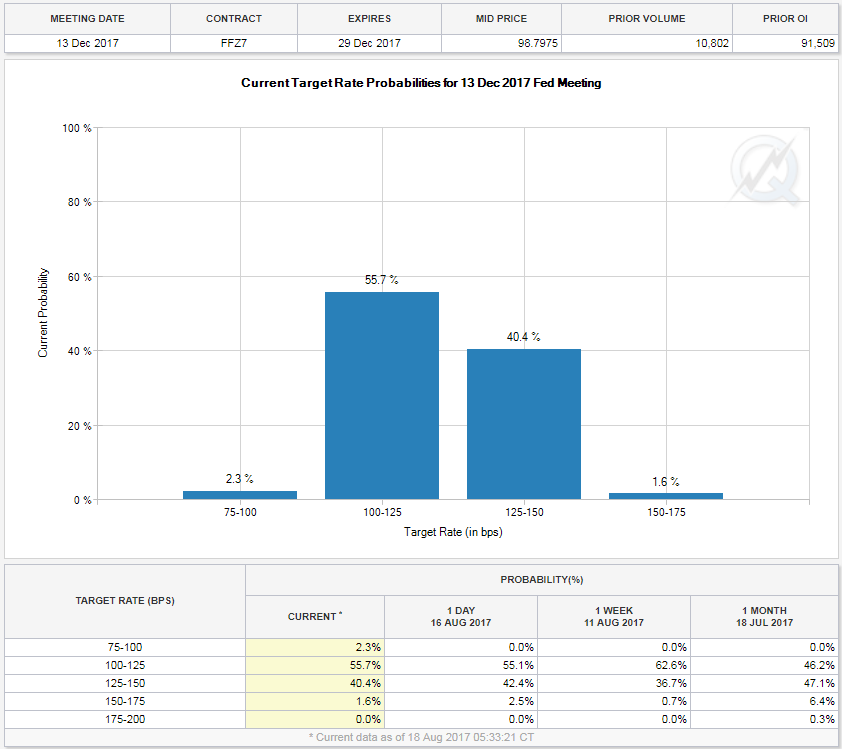

The yen is being favoured once again in the fx space and is now on course for a third consecutive day of gains. The yen is looking particularly bullish against the pound and a break below 140 in the pair could be the catalyst for another push lower. The dollar is a little soft once again, with Wednesday’s minutes providing the dovish undertones that traders have been waiting for in recent months. With Treasury yields continuing to creep lower and the probability of a rate hike now standing at only 42%, the Fed may now have a job on its hands delivering on a third increase this year.

Source – CME Group FedWatch Tool

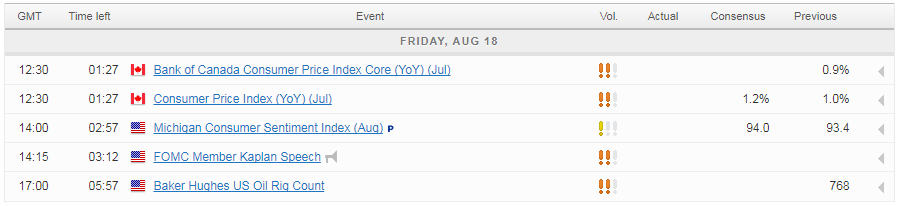

The preliminary UoM consumer sentiment figure is the only notable economic release on Friday but we will also hear from the Fed’s Robert Kaplan again after he yesterday called for patience on rates in the face of weak US inflation.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.