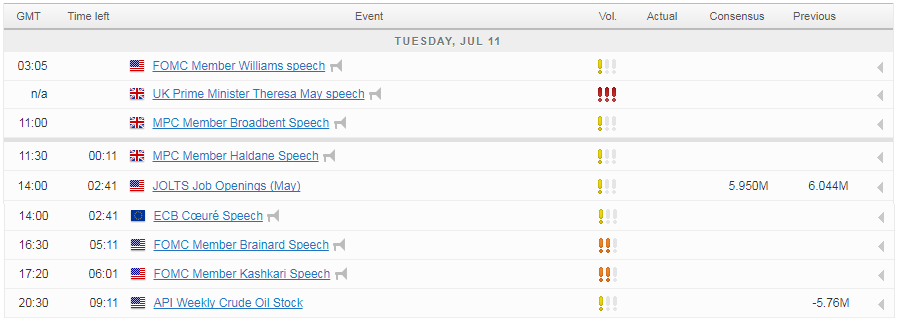

As is likely to be the case for much of this week, central banks will be in focus again on Tuesday with two policy makers from the Bank of England and two Federal Reserve officials scheduled to appear.

BoC and Yellen Remains This Week’s Headline Events

Wednesday remains the most notable session of the week, with Fed Chair Janet Yellen testifying before the House Financial Services Committee and the Bank of Canada potentially raising interest rates for the first time in almost seven years. A rate hike from the BoC would come as a number of the G7 central banks adopt a more hawkish stance, despite the economic data not necessarily supporting such a move.

It would appear there is a sudden coordinated desire to start moving away from the ultra-accommodative monetary policies that have been necessary over the past decade, even if the economic data doesn’t necessarily warrant higher rates. The ECB is widely expected to lay out plans for ending its asset purchase program later this year, while the Fed is likely to announce plans to reduce its balance sheet in September and the BoE and BoC have, somewhat out of the blue, deciding the time to raise interest rates has arrived.

EUR/USD – Euro Remains Subdued, Markets Eye Yellen Testimony

We’ll have to wait 24 hours to find out what the BoC is going to do and whether more hikes are planned for the months ahead, and to hear what Yellen has to say about the path of interest rates and the balance sheet. Today though, we could get more insight from two prominent BoE policy makers and two FOMC voters, which should be of interest to traders.

Will BoE’s Broadbent Echo |His Colleagues Hawkish Rhetoric

The BoE’s Chief Economist Andy Haldane has already recently made his feelings known, suggesting that while he never backed a hike at the last meeting, he could be persuaded to do so if the data performs as expected. Deputy Governor Ben Broadbent has been relatively quiet until now though and should he echo the views of Haldane in recent weeks, it could send a strong signal to the markets that the BoE won’t be far behind the BoC, if it does in fact raise interest rates tomorrow.

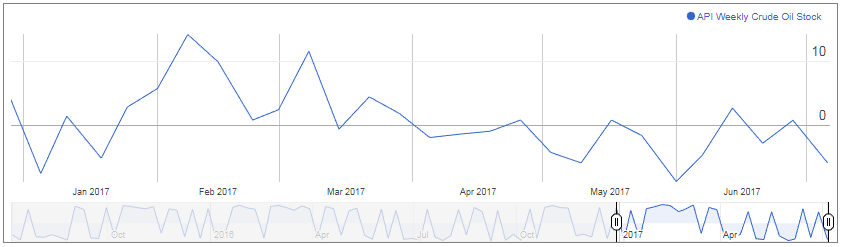

Oil Inventory Data Released as Prices Near 11-Month Lows

The data will be less of a focal point today, although we will get JOLTS job openings for the US and oil inventory data later on in the session from API. Brent and WTI remain under pressure despite inventories having fallen consistently in recent months, with traders instead focusing on rising oil rigs in the US and higher output from Nigeria and Libya. Another large drawdown last week may provide some reprieve for oil, with it not trading far from its 11-month lows.

Rate Differentials Hinders Yen

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.