US equity markets are poised to open slightly higher on Tuesday, building on the recovery we saw throughout yesterday’s session after indices started the week lower in response to Donald Trump’s failed healthcare bill.

Equity markets rebound after questions raised over Trump’s ability to deliver

The failure to generate support for the bill despite delivering a last ditch ultimatum to lawmakers is seen as potentially being a sign of weakness and even political naivety from Trump which has cast doubt on whether he’ll face similar problems when it comes to his other policies. Ultimately, the more than 15% rally in equity markets, along with the rise in the US dollar and Treasury yields, since Trump’s victory has been built on the belief that he will deliver and if doubts are in fact creeping in, those gains will start to disappear.

DAX Punches Above 12,000 as Investors Await Next Trump Move

Another explanation could simply be that investors are capitalising in on Trump’s healthcare issues – a policy that was not a key driver of the rally since November – and locking in some profit on the move. Once markets get back to more attractive levels, we may once again see the dips being bought and optimism in Trump to deliver on tax reform and fiscal stimulus will suddenly return as well. With Trump promising to move on to tax reform now that the healthcare bill failed, we may not have to wait too long for investors to become more optimistic again. That said, if tax reform fails then investors will not be so forgiving.

Key technical support levels being tested in the Dow, S&P and USD

If the latter is true, then the question becomes at which point do investors start seeing value again. The Dow and S&P both rebounded yesterday off their 55-day SMA, the first time they’ve threatening to break below here since shortly after the election in November. The fact that this coincided with a similar bounce in the US dollar index of its 200-day SMA would suggest both are testing significant support levels at the moment and a break of these could trigger further losses.

EUR/USD – Euro Subdued, US Consumer Confidence Next

Yellen one of four Fed officials making an appearance today

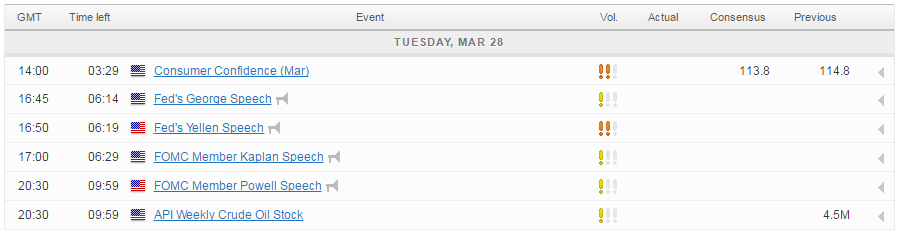

There isn’t much to watch on the economic calendar today, with CB consumer confidence and API oil inventories the only notable releases. We will, however, hear from four Fed officials including Chair Janet Yellen. Given how markets have responded to the dovish hike this month, it will be interesting to see whether policy makers remain along these lines or start talking up the prospect for another hike in June.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.