An emotional start to Monday for precious metals traders in Asia. Silver breaking 20.00 shortly after Shanghai metals opened. XAG/USD then rallied a whopping 7% in ONE hour to around 21.10 as early Chinese demand turned into a stop loss rout. The door is always small when everyone runs for it at once.

The GOLD/SILVER ratio may also have played its part. Having broken 71.00 on Friday in New York we took out the Friday lows in Asia as well for a spike to 64.00.

Calmer heads have since prevailed and Silver now lies at 20.25 still some 2.50% higher on the day.

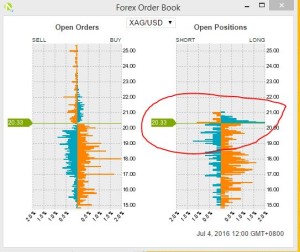

Interestingly in OANDA Labs, much of the long positioning this morning seems to have been put on post the break of 20.00 as well.

Support intra-day will be the New York high at 19.85 with resistance this mornings high around 21.15.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.