It’s been a relatively slow start to the week but things should pick up on “Super Thursday” as we get the latest monetary policy decision from the Bank of England, the minutes from the meeting, the latest inflation report and we hear from Governor Mark Carney.

The BoE has been one of the least active central banks for quite a while now but as we approach the EU referendum, investors have become much more interested in what it has to say. In the absence of Brexit risks, the BoE was widely seen as remaining inactive for some time yet but with the polls suggesting the vote could be very close, investors will be interested to know what a vote to leave to mean for U.K. monetary policy.

At this stage it is not clear what approach the BoE would take to a vote to leave the EU. The central bank may be tempted to ease monetary policy further in order to offset the immediate negative implications of an exit vote and support the economy. The problem here being that a vote to leave would more than likely lead to a significant depreciation of the pound that would risk inflation rising well above target at a time when the central bank is loosening monetary policy rather than tightening it – the normal policy response to such a scenario. That said, we have seen the BoE overlook temporary overshoots in recent years.

If the central bank was to consider tightening monetary policy to avoid overshooting its inflation target, the combination of higher rates and a Brexit would risk exacerbating the shock to the economy and could send it into an even deeper recession. Clearly a vote to leave next month would leave the BoE in a very tight spot.

Carney has a very tough job on his hands today in communicating the economic impacts of a Brexit and the implications for monetary policy while trying to remain neutral on the issue and avoid once again angering the exit campaign. Everything he says today will be heavily scrutinised and could trigger a lot of volatility in the pound and U.K. bond markets as markets try to get to grips with all the possible eventualities.

The central bank will also release its inflation and growth forecasts today which could throw another spanner in the works. Ideally the BoE would release two sets of forecasts, one in the case of a vote to remain and another in the case of a vote to leave the EU, but this is unlikely. Instead, the BoE will probably assume the status quo and so in the event of an exit, the forecasts would be worthless.

One final thing to consider is whether the recent economic weakness, probably largely driven by uncertainty over the U.K.’s future, has changed the BoEs view on the near term view for interest rates. Should the BoE signal that the next move in interest rates could be lower even in the event of a vote to remain, we could see the pound take yet another hit and yields on U.K. debt head south.

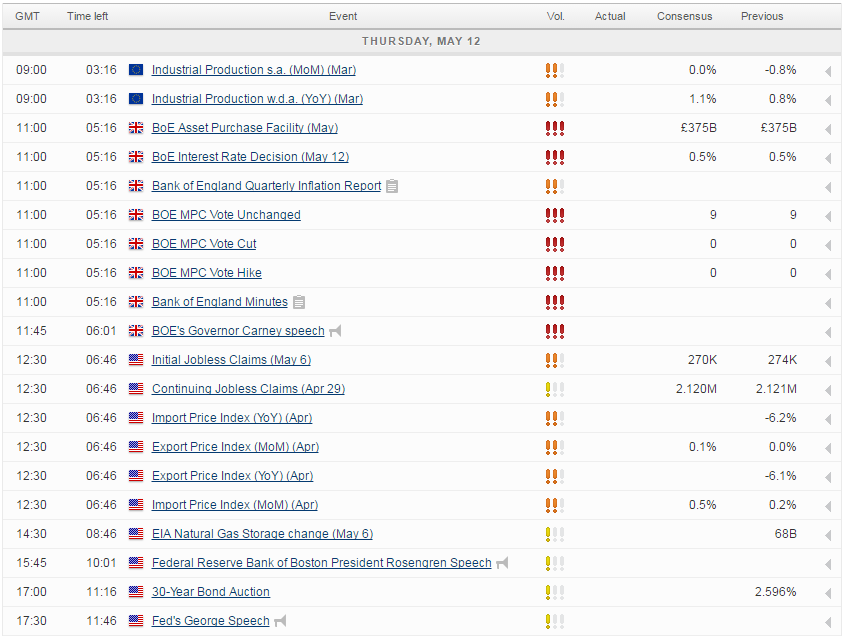

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.