European equity markets are expected to open higher on Monday, tracking moves in Asia overnight on the back of gains in oil as fires in Canada’s oil sand region drove large supply disruptions.

It is thought that production in the region has now fallen by more than a million barrels per day which could easily support further increases in prices in the coming weeks, especially coming alongside the continued cuts in the U.S. where output has now fallen by almost 800,000 barrels per day from its peak last year. Rising demand from China, as the economy picks up again in response to numerous fiscal and monetary stimulus measures, could also support further gains in oil prices against the supply disruption backdrop.

China’s trade surplus rose in April but once again this came on the back of imports falling at a faster rate than exports which is clearly not ideal. The timing of the Lunar New Year is likely to have distorted the picture again this month but overall, we do appear to be seeing some improvement in exports, helped considerably by the weaker currency. Conditions are likely to remain challenging though and more stimulus may be necessary to continue to drive improvements and help the economy achieve its ambitious growth targets.

The Bank of Japan monetary policy meeting minutes, released overnight, showed an ongoing split among policy makers over the benefits of negative rates which has clearly not subsided since it was implemented. The split could make further rate cuts more difficult to pass leaving the central bank with limited options given the size of its asset purchase program. Still, we are seeing some yen weakness at the start of the week, down around half a percent against the dollar, euro and pound, although these moves are relatively minor compared to the gains it has made previously.

On the agenda today we have some economic data being released including eurozone Sentix investor confidence and U.S. labour market conditions index. Once again though focus will be on Greece as the eurogroup meets to discuss its latest bailout package after the government passed some very unpopular measures including pension cuts and tax hikes. As always, these talks are not straightforward but hopefully we will see some progress today, particularly on the debt relief measures which has proven to be a very controversial topic among the countries creditors.

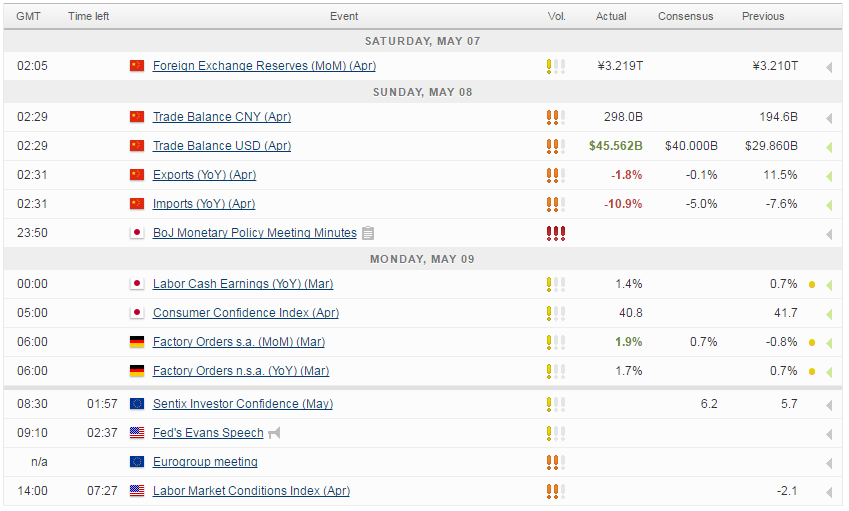

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.