European markets are once again expected to open little changed on Tuesday following an uninspiring start to the week after a mixed bag of Chinese data failed to provide much direction for the markets.

Between not being able to trust the GDP data, commodities being hit by industrial production figures, retail sales beating expectations and talk of more monetary stimulus, there wasn’t really a clear message to take away. Chinese growth remains a very real concern, not just for the country itself but many others in the region that rely on it for trade.

Australia has been one of those country’s that’s been hammered by the slowdown in China but the RBA minutes released overnight offered a more upbeat assessment of its economy, particularly its rebalancing efforts aimed at making it less reliant on the ailing mining industry. It was all well and good putting its eggs in one basket when the industry was booming but the sharp decline in commodity prices and a slowing Chinese economy has forced the country to find a more sustainable source of growth and clearly progress is being made.

There are still a number of risks facing the Australian economy, growth in China and east Asia continuing to be a key one, as well as house prices and commercial property, as highlighted in the minutes. While the RBA didn’t drop any hints of a rate cut in the coming months, tightening financial conditions following Westpacs decision to raise mortgage rates by 20 basis points is likely to have put one back on the table. We could now see another cut from the RBA as early as November to offset these tightening conditions.

Bank of England hawk, Ian McCafferty, who voted for a rate hike again at the last meeting, despite growing belief in the markets that this won’t come for another 12 months, is due to speak this morning. McCafferty has long stood by his belief that the BoE should raise rates sooner and slower if it wants to avoid damaging the economic recovery rather than delaying and risking having to raise them too fast. I don’t expect his viewpoint to change today although it will be interesting to see whether there is any softening in his tone or if he believes other policy makers are close to joining him in voting for a hike.

We’ll get more housing data from the U.S. this afternoon, with building permits and housing starts figures being released. We’ll also hear from William Dudley and Jerome Powell, both voting members of the FOMC, this afternoon which should offer further perspective on the rate hike situation in the U.S. ahead of next week’s meeting.

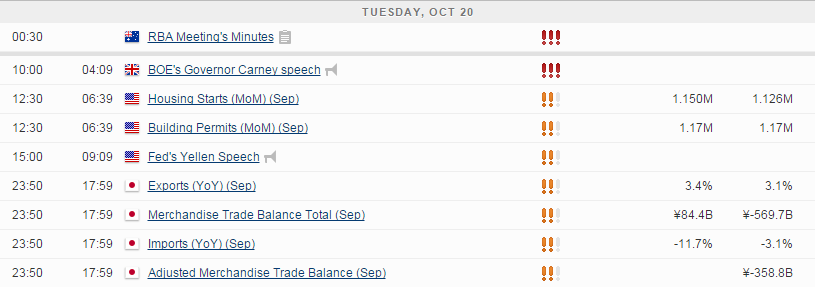

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.