As we head into what could be a very interesting weekend for Greece, investors appear surprisingly calm, with futures currently pointing slightly to the upside ahead of the European open. They’re not necessarily displaying the kind of risk aversion you might typically see ahead of such an uncertain weekend.

Of course, there have been significant declines in European indices over the last few weeks as negotiations have gone from bad to worse so much of this has already been priced in. In fact, from a technical standpoint, many indices in Europe are giving a rather bullish signal, with yesterday’s candle being either a bullish hammer or completing a bullish engulfing pattern.

The eurogroup meeting on Thursday once again failed to produce any kind of agreement on Greek reforms and despite all of these discussions, the two sides appear as far apart as ever. Neither side is willing to compromise on the final issues which are believed to be pension reform and VAT. Greece is also pushing for debt forgiveness which is a long shot really given that the country is requesting more aid.

An E.U. summit has now been arranged for Monday as eurozone leaders try once again to resolve the impasse. If nothing changes between now and then I don’t see what they hope to achieve that has not been possible already. Eurogroup Head Jeroen Dijsselbloem claimed yesterday that already, the implementation of a deal and disbursement to Greece is unthinkable before 30 June, when Greece needs to repay €1.6 billion to the International Monetary Fund.

The European Central Bank is believed to be holding a teleconference today to discuss extending emergency liquidity assistance (ELA) to Greece. Reports yesterday that ECB Executive Board member Benoit Coeure, when asked if Greek banks would open today, replied “tomorrow, yes. Monday, I don’t know” would suggest the central bank may be considering cutting them off which would create some very serious issues for the Greek government.

For now, the ECB may opt to apply further haircuts to what it accepts from Greek banks in exchange for the liquidity assistance in an attempt to ramp up the pressure on Greece ahead of Monday’s summit, without causing a complete meltdown. It’s only a matter of time until the banks are cut off altogether as they can’t possibly be considered solvent when cash is being withdrawn at the rate it is.

We could see cash withdrawals in Greece increase dramatically today, having already picked up significantly this week from around €200-300 million per day to €2 billion between Monday and Wednesday. If what Coeure said is true, capital controls could be in place by Monday which would cause widespread panic given that the banks have become so dependent on ECB funding.

In the absence of any major data releases today, the Greece story is likely to dominate once again. It will be very interesting to see whether the jitters kick in as we progress through the session and investors begin to become more risk averse ahead of such an uncertain weekend.

The FTSE is expected to open 10 points higher, the CAC 3 points higher and the DAX 31 points higher.

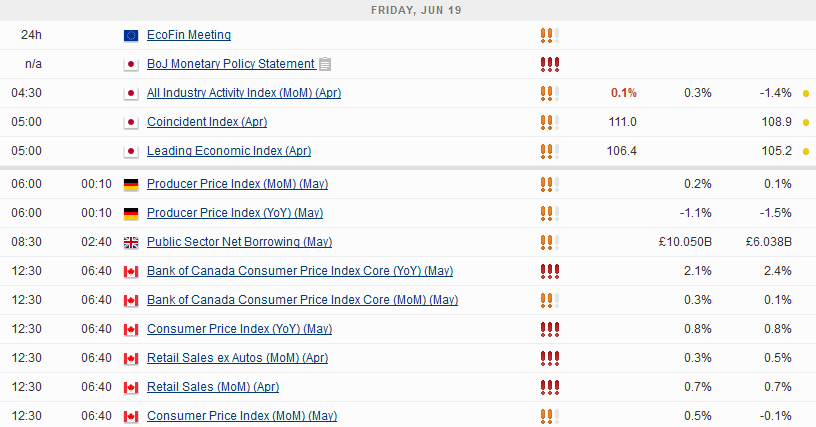

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.