A sell-off into the end of the session on Wednesday appears to be feeding into stock futures this morning after the Federal Open Market Committee minutes once again showed policy makers brushed off first quarter weakness as “transitory” leaving a rate hike this year well and truly on the table.

There wasn’t much to take from the minutes this month, they were very much consistent with the statement that was released following the decision and the message from the other meetings. They also offer an outdated view on the economy as they don’t take into account the April data, which didn’t show the kind of bounce that would be expected if the first quarter slowdown was in fact “transitory”.

The jobs report didn’t blow anyone away, retail sales slumped again, hourly earnings ticked lower and consumer sentiment fell to a seven month low. At what point does the data reflect a cooling in the economy and not just a temporary slowdown. As soon as the Federal Reserve acknowledges that this slowdown is not transitory, if they do, any rate hike this year is off the table. They cannot hike while the economy is cooling and if this period of disappointing data continues into May, it may be time to accept this is not a temporary slowdown.

Fed Chair Janet Yellen is due to speak on Friday and investors will be keen to hear whether she still stands by the minutes from the April meeting or whether her position has changed based on the April data. I think this is a bigger event this week than the minutes and the one that has the potential to have a big impact on the markets.

I doubt Yellen will change her stance at this stage though. Even one of the most dovish members of the Fed – Charles Evans – acknowledged this week that a June hike isn’t off the table, although I think everyone would be surprised to see it at this stage. He suggested that they should hold off until the start of next year but if this is the dovish view, I have to assume that the consensus remains this year. Today we’ll get the views of Stanley Fischer, Vice Chairman of the Federal Reserve, which could offer some insight into Yellen’s views tomorrow.

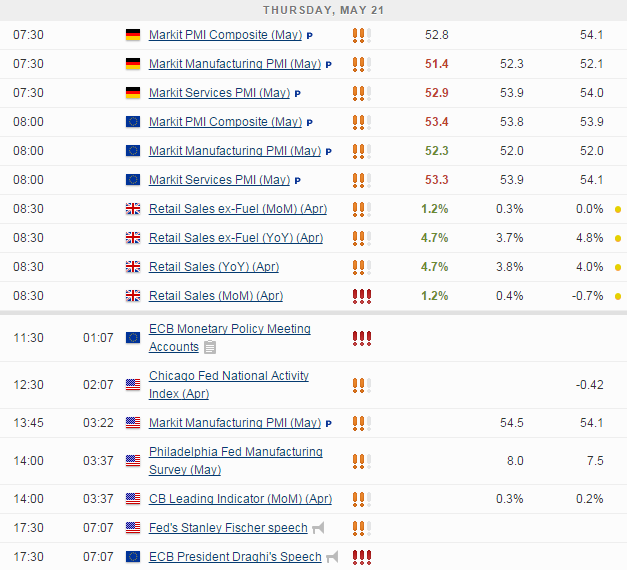

There’s also some economic data due out of the US today including weekly jobless claims, which are expected to rise slightly to 271,000, the preliminary manufacturing PMI for May, existing home sales for April and the Philly Fed manufacturing index for May. This should provide plenty of catalysts for the markets ahead of tomorrow’s speech from Yellen.

The S&P is expected to open 4 points lower, the Dow 41 points lower and the Nasdaq 15 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.