Greece finds itself on the brink of default and facing a possible exit from the eurozone, banking collapse, and massive financial crisis. Sadly, it’s just another day in the life of a country forced to endure five years of crippling austerity, high unemployment, and a shrinking economy.

On Monday, the Eurogroup of finance ministers will meet in Brussels to try once again to thrash out a deal that would enable Greece to receive €7.2 billion in bailout funds that were agreed as part of the extension back in February. In order to access the funds, Greece must agree on a list of reforms with its creditors, something it has thus far refused to do.

Negotiations were always going to be more difficult than in the past with Prime Minister Alexis Tsipras’s government after it assumed power last January. Tsipras and his Syriza Party colleagues were voted into power on a pledge to reverse the austerity measures imposed on Greece by its international creditors.

The Brussels Group that replaced the Troika at the negotiating table have met on numerous occasions in recent months, yet the result remains the same: a deadlock. Greece continues to insist on offering an alternative list of reforms aimed at raising the same amount of cash as those offered by its creditors, while protecting its pensions and raising the minimum wage. The Brussels Group has repeatedly rejected these proposals as they are either not comprehensive enough or the numbers don’t add up.

It’s got to the point that discussions between Greek Finance Minister Yanis Varoufakis and his counterparts in the Eurogroup have become quite heated, most recently at the meeting in Riga, Latvia on April 24. The bad blood and subsequent standstill in negotiations forced Tsipras to put together an alternative negotiating team, effectively demoting Varoufakis, in an effort to get a deal done.

The problem that Greece faces is that the Troika — the European Commission, International Monetary Fund (IMF), and European Central Bank (ECB) — do not want to set a precedent for future negotiations with other bailed-out countries. Moreover, Spain will hold a general election later this year, and giving into Syriza’s demands now could drive further support for Podemos (a similar left-wing party that was formed in 2014 and could win the election). A repeat of these negotiations next year with members of Podemos is the last thing they want. Instead, the Troika is hoping that Spain’s economic recovery continues, and support for Podemos will wane, discouraged by the lack of concessions won by Greece.

How Have the Latest Round of Negotiations Gone?

Comments from officials involved in the negotiations have been mixed, which suggests there remains a number of issues neither side is willing to budge on. Recently, a Greek government spokesman claimed that Athens “won’t go beyond the limits of our red lines. It’s clear that we cannot cut pensions.” It would appear that its creditors still expect Greece to make large concessions while making few in return.

Other comments have been more positive. Some officials insist that progress is being made, although very little information is being released regarding what kind of progress they are referring to, and what the remaining stumbling blocks are. This makes it difficult to determine whether a deal will actually be agreed on by the time the Eurogroup meets on Monday.

Thomas Wieser, Head of the Eurogroup, has claimed a comprehensive agreement won’t be done by Monday, but he insists a deal will get done. This would be yet another deadline that has come and gone for Greece and its creditors, with one additional snag on this occasion. Greece must repay €763 million to the IMF on Tuesday, and it’s not clear whether Greece has the funds to make the payment. Athens has already called in all public sector reserves to enable the country to make Wednesday’s €200 million repayment. No one seems to know how much cash the country has left and when it will default.

Will Anything Happen Over the Weekend?

These negotiations have a tendency to go right down to the wire, which would be Monday night at the earliest. If Greece can find a way to make the €763 million payment to the IMF on Tuesday without assistance, negotiations could drag on even longer.

The problem is that the markets are very volatile at the moment, and any suggestion that Greece could be allowed to default, or that negotiations have collapsed and it will default, could provoke a strong reaction.

Any downside in the euro could be exacerbated by the ECB’s bond-buying program that has already weakened the single unit significantly, and could be increased if a default had an adverse effect on eurozone growth. This potentially occurring over the weekend would also mean that markets are likely to gap when they reopen. As we’ve seen on numerous occasions throughout the eurozone debt crisis, these gaps can be quite large.

It is worth considering that Greece technically defaulted back in 2012 when its privately held debt was restructured. While this is unlikely to happen again, it does show that a Greek default doesn’t necessarily mean the country will be kicked out of the eurozone.

A much bigger problem would arise if Greek banks were cut off from the ECB’s emergency liquidity assistance program. This could trigger a collapse of the banking systems and much bigger financial crisis than the country currently finds itself in. This would more than likely lead to Greece exiting the eurozone, as it would be better at this stage for the country to re-issue the drachma and rebuild its broken economy.

That scenario is highly unlikely though, as both Greece and its creditors would suffer considerably, and confidence in the eurozone would be shattered just as the economy was starting to show signs of recovery. Such a scenario would also contain an element of contagion. If it did, it could have a dire impact on the markets.

Caution Is the Order of the Day

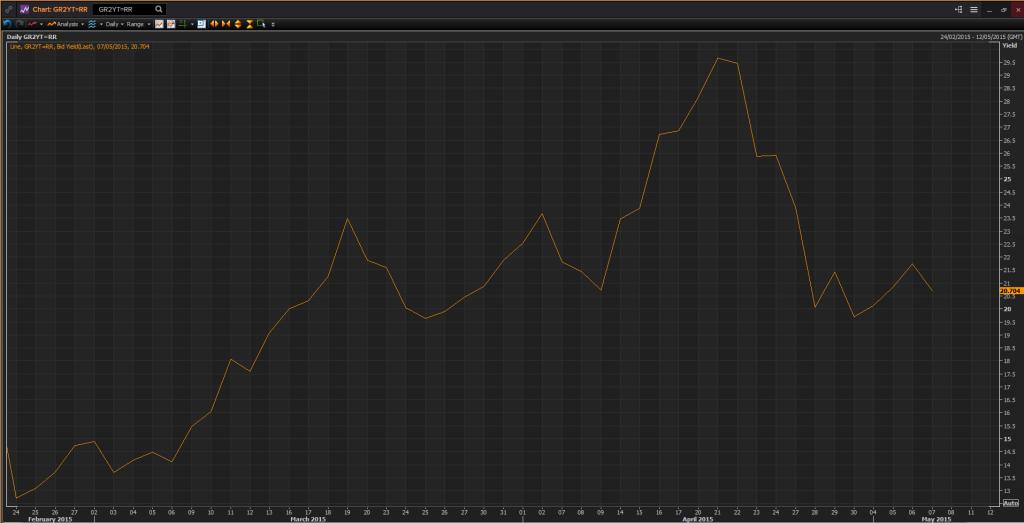

We have certainly seen a certain amount of caution being taken by investors. Look at the yield on two-year Greek debt; it rose to 29.66% on April 21 as the default risk grew dramatically. This has since fallen to 20.7%, which still represents a massive premium, indicating investors are far from confident that a deal will be reached.

*Taken from the Reuters Eikon platform

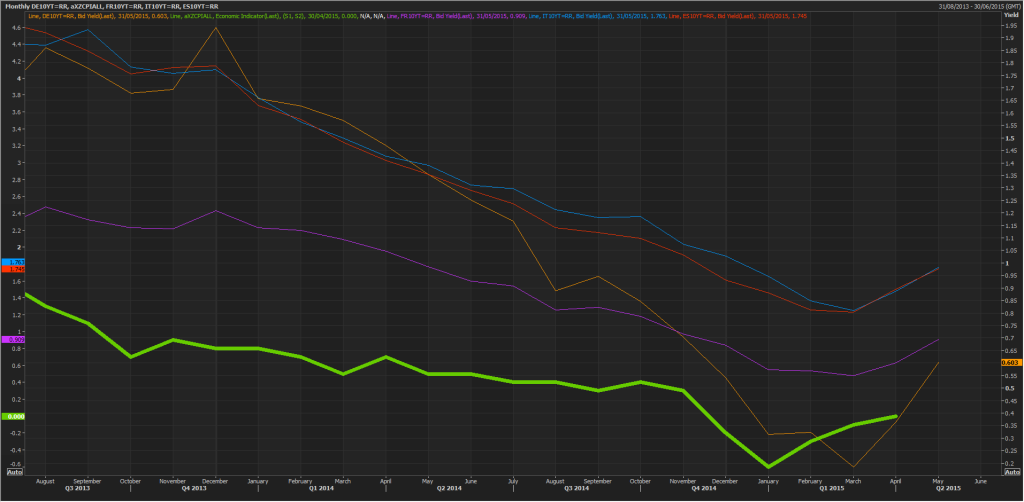

Other eurozone bonds have also been on the rise since the middle of April but are being driven by changing inflation expectations after the eurozone deflation subsided last month. This was largely a result of higher oil prices, which have continued to climb leading to expectations that inflation pressures remain to the upside in the eurozone.

This has led to speculation that the ECB could end its quantitative easing program before September 2016, which has offered support to bond yields and the euro.

*Taken from the Reuters Eikon platform. The thick green line represents eurozone CPI inflation data.

A certain amount of the rise in yields may be driven by Greek uncertainty but the above chart would suggest this is minimal. This may be because the contagion risk is much smaller than it was in 2010, when the crisis first erupted. At the same time, the ECB is buying €60 billion of bonds each month which will be helping to keep yields lower.

What Do the Charts Show?

EUR/USD has seen a prolonged period of weakness and was overdue a correction of some kind, that is what we’re now seeing. The pair broke above the neckline of a double bottom on April 29 and has continued higher since. One of the benefits of the double bottom is that if offers potential price targets, based on the size of the formation. In this case, that is around 1.1570. Given that just below here we have a previous support and resistance area and the 50 fibonacci level – December 16 highs to March 13 lows – we may see the pair run into resistance just ahead of this projected target.

Of course, if Greece fails to agree to a deal on reforms Monday and defaults Tuesday, then these technical levels go out of the window, and the euro would make a sharp move to the downside. The severity of the mood to the downside would depend on the kind of default it would be. Another restructuring deal for example may be seen as a longer term positive for the eurozone as it would make Greece’s debt more sustainable.

If a deal is reached on Monday, this could offer additional support to the euro, potentially pushing it towards 1.1750 – 1.1850 as the can is successfully kicked a little further down the road.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.