The post-FOMC collapse in the US dollar appears to have been very short-lived, as greenback bulls swooped in to take advantage of the pull back which they saw as a great opportunity to get long at a bargain price.

Ahead of the FOMC meeting the long dollar trade was looking very crowded, particularly against the euro. A combination of a hawkish Federal Reserve and dovish European Central Bank gave traders the impression that the pair could only head in one direction and clearly no one wanted to miss out. This meant that anything other than a very hawkish Fed on Wednesday was likely to prompt a pretty sharp correction in the dollar, which is exactly what we saw. This was helped greatly by the fact that not only was the Fed not very hawkish, it was actually a little dovish.

The problem was that between EURUSD shorts being covered and stops being triggered, the correction in the pair was also quite overdone, it certainly didn’t warrant the 4% rally that we saw. The weakness in the dollar was very good for US equities and commodities, the benefit of which filtered through to Asia overnight and early trade in Europe.

However, as with any overdone trade, things tend to correct and that is what we’re seeing in the dollar this morning. The euro now appears to have stabilized around 1.07 against the dollar, down more than three cents from yesterday’s highs and up around two cents from its lows. After all of the activity of the last couple of weeks, I wouldn’t be surprised to see EURUSD fall into a trading range now, between 1.0650 and 1.09, or beyond that, 1.05 and 1.10. While people were getting excited about parity, I think we may have to wait for later in the year for that, potentially when the Fed does eventually hike rates.

The stronger dollar today does appear to be weighing slightly on commodities this morning which may be responsible for the pullback in European indices. US futures are looking little changed, following yesterday’s. Maybe today we’ll see some stabilisation in US equities as we see it in the dollar.

I see some potential risk to the downside in oil prices today, particularly in US WTI crude, as yesterday’s 9.6 million barrel build in inventories didn’t appear to have much of an impact on prices due to the dollar’s strength. With the dollar pulling back today, we may see the build get priced in more, even though WTI is already near the lower end of it’s trading range, around $43. This could put some pressure on that support and make fresh six year lows.

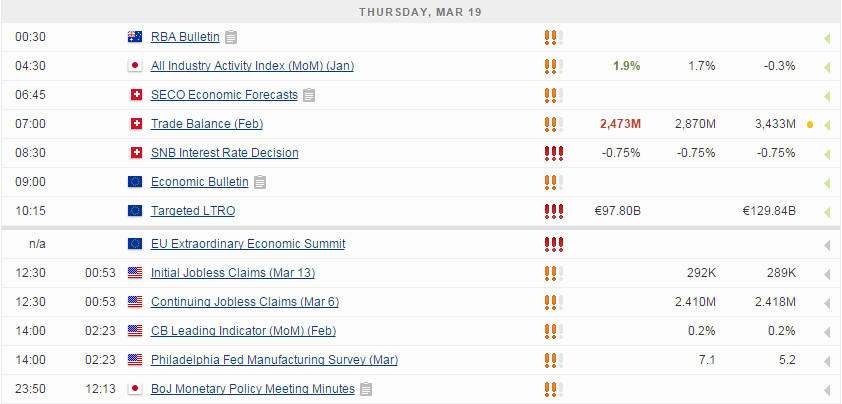

There isn’t too much to focus on today on the news front. We have some economic data due out, most notable jobless claims and the Philly Fed manufacturing index. In Europe, the EU Summit will get underway as Greek leaders try and sell its reform package to its creditors, probably unsuccessfully as has been the case for weeks. Its creditors are fast losing patience with Greece and the odds are growing that we will see new elections this year as Greek Prime Minister Alexis Tsipras refuses to accept the conditions imposed on it by the Troika. A Greek exit would be the alternative and I don’t think that will appeal to him either.

The S&P is expected to open 1 point lower, the Dow 20 points lower and the Nasdaq 6 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.