Interesting day for AUD/USD once again. Prices gaped lower on open following the release of lower than expected Chinese Exports figures. Y/Y Exports for the month shrank by 0.3% vs an expected 5.5% growth. This hit AUD heavily as China is the main trade partner with Australia.

Risk appetite took yet another hit when the measure to lift US Debt Limit failed in the Senate. This is extremely bearish for the market, evident via the fall in Asian stock prices and even US stock futures. AUD/USD which is essentially a “risk-based” currency pair traded lower predictably.

But it should also be noted that the potential default risk is bearish for USD as well, and as such we should actually see AUD/USD trading higher. The 2 opposing forces probably resulted in price action behavior this morning, where AUD/USD pushed up higher immediately after the gap, with prices filling back up the gap as market appears to be focusing more on the US issues currently.

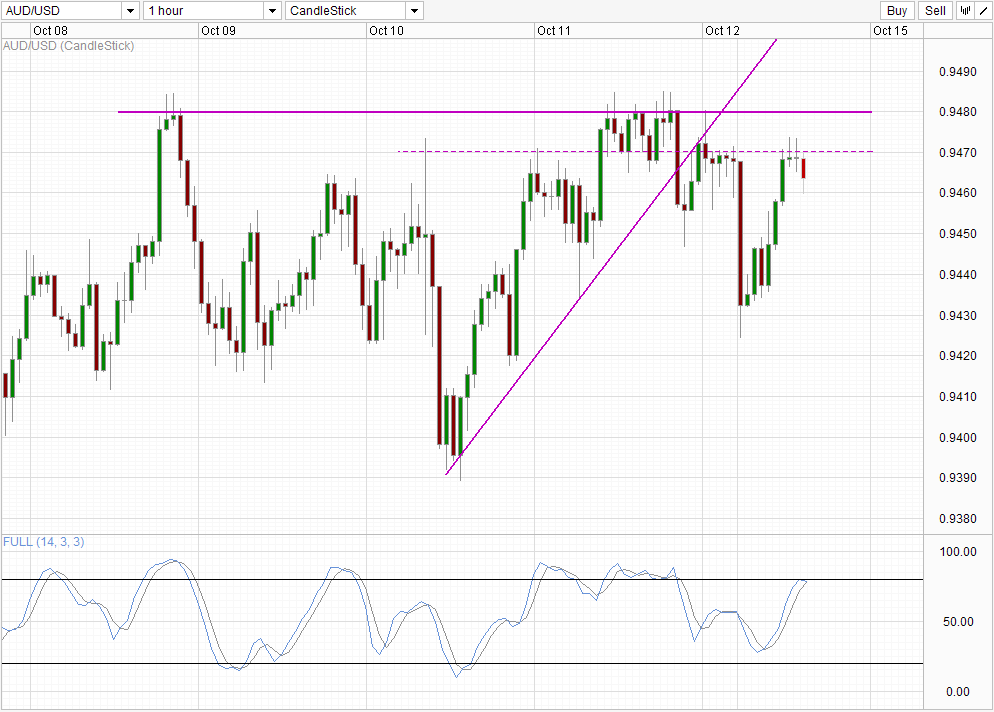

Technicals shows 0.947 resistance holding nicely, with Stoch curve pushing lower rebounding off the 80.0 level suggesting that we are currently within a bearish cycle. Immediate bearish target is 0.945 round figure which has been a soft ceiling between 8th – 10th Oct and the floor on 11th Oct.

Even if prices managed to break 0.947 and push higher, 0.948 will provide further resistance, with Stochastic readings likely deep within the Overbought region, decreasing the likelihood of further price rally.

The likelihood of long-term recovery of AUD/USD becomes even bleaker when we add in fundamentals, with Australia’s economic outlook looking weak. Furthermore, should US manage to resolve its Debt Ceiling and Government Budget issues as widely expected, we will see short-term USD strength entering back into play, pushing AUD/USD lower.

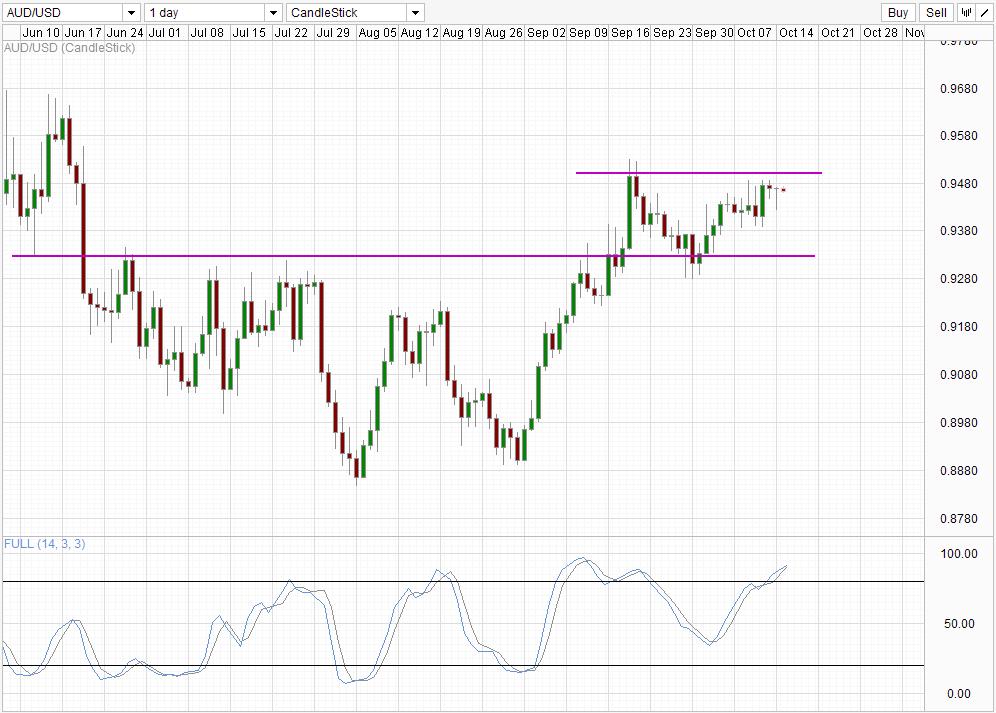

Daily Chart

This bearish outlook is also true on the Daily Chart where prices is trading between 0.933 – 0.95, with price close to the ceiling while Stochastic readings are deep within the Overbought region hence favoring an eventual bearish move to emerge. Even if we manage to break 0.95, price will face strong resistance around 0.97, with prices needing to breach above 1.015 in order to impair current strong bearish trend that started in April 2013.

Looking within Australia, RBA rate cut expectations have fallen tremendously, with swaps pricing in a 0% chance of rate cuts within the next 12 months following RBA’s less dovish statement earlier this month. This help to heap on bullish pressure in the short-run, but should economic outlook in Australia continue to stay stagnant, RBA will be forced to ease again and drive AUD/USD lower again.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.