In their report released earlier today the Organisation for Economic Co-operation and Development said the outlook is not good as there is no recovery in sight, and the only positive gains are in temporary jobs which are at best a stop gap measure.

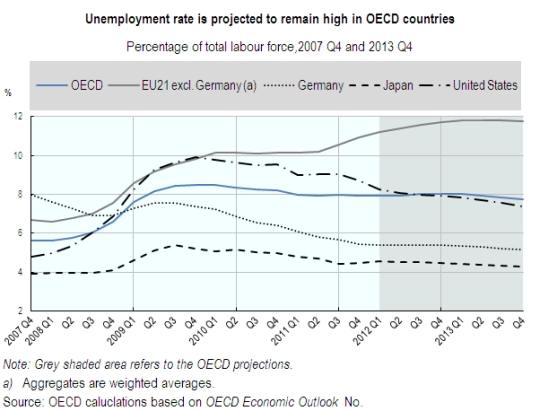

The Employment Outlook 2012 says that the OECD-wide joblessness rate is forecast to remain high at 7.7% in the fourth quarter of 2013, close to the 7.9% rate in May 2012. This leaves around 48 million people out of work across the OECD. In the Euro area, unemployment rose further in May to an all-time peak of 11.1%.

To get employment rates back to pre-crisis levels, about 14 million jobs need to be created in the OECD area. Young people and the low-skilled continue to bear the brunt of the jobs crisis.

Moreover, job creation during the weak recovery of the past two years has often been concentrated in temporary contracts because many firms are reluctant to hire workers on open-ended contracts in today’s uncertain economic environment, says the report.“The recent deterioriation in the economic outlook is very bad news for the labour market,†said OECD Secretary-General Angel GurrÃa, presenting the report in Paris. “It is imperative that governments use every possible means at their disposal to help jobseekers, especially young people, by removing barriers to job creation and investing in their education and skills. The young are at most risk of long-term damage to their careers and livelihoods. Targeting the most cost-effective policies is essential.â€

The situation varies widely between countries. Unemployment has been rising in the European Union since the end of 2011, but has been stable at around 8.25% in the United States. In OECD countries, the unemployment rate was highest in Spain, at 24.6%, with double-digit rates also in Estonia, France, Greece, Hungary, Ireland, Italy, Portugal and the Slovak Republic.

For the full report visit the OECD

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.