Indices Pare Strong Gains

US investors appeared to find their mojo again on Thursday but that may not last long, with futures currently in the red and markets in Europe on course for a second consecutive weekly decline.

Strong gains yesterday left US equity markets back within touching distance of record highs and while that will have given some investors’ confidence that the recent stumble has passed, an inability to hold onto these today still leaves markets vulnerable to a broader pull-back. A failure to make a new high is typically another warning that the trend is weakening, especially coming after a month in which it has fallen into a sideways trend, rather than continuing its gradual ascent.

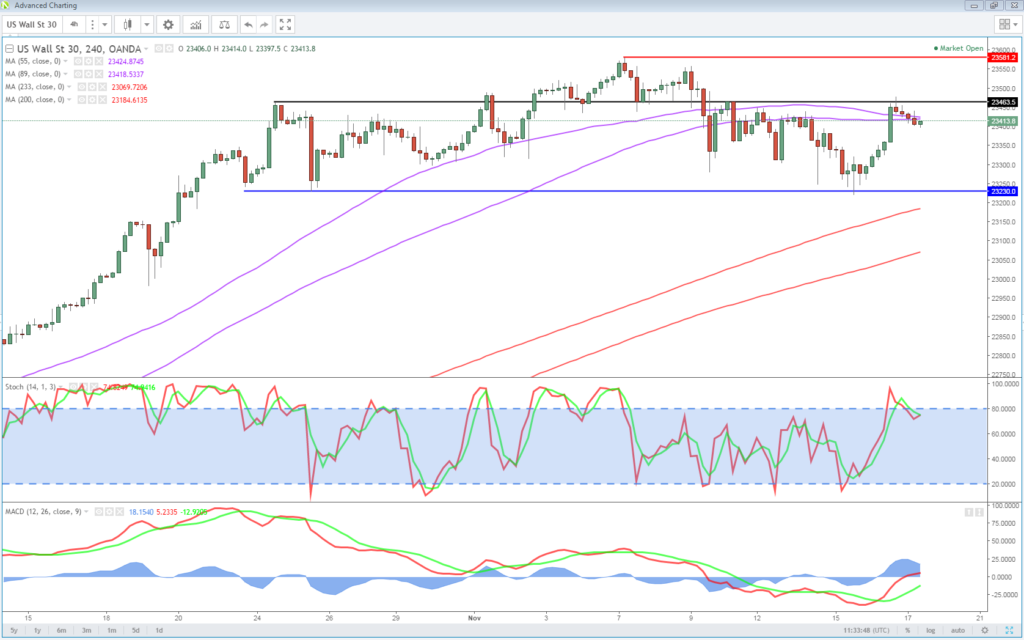

Dow Looks Vulnerable Below 23,250

From a technical perspective, 23,250 now looks like a very important level for the Dow and a break below here could trigger a bigger correction in the index. Given the steady gains we’ve seen over the last few months, even move back towards 23,000 would only represent a small correction in the most recent rally and would be healthy for markets.

OANDA fxTrade Advanced Charting Platform

European equity markets are also trading in the red this morning and while this is being attributed to downgrades and earnings, I think it’s simply part of a broader move away from risk and a decision to lock in some profits. Slow progress on tax reform in the US and reports that Robert Mueller has issued a subpoena to the Trump campaign in relation to the Russia probe are two other things that are being blamed for the more risk averse tone but I think in reality, neither of these would have had such an impact a month ago and it’s probably more a reflection of a less bullish investor.

DAX Edges Lower, Investors Look for Cues from ECB, Buba

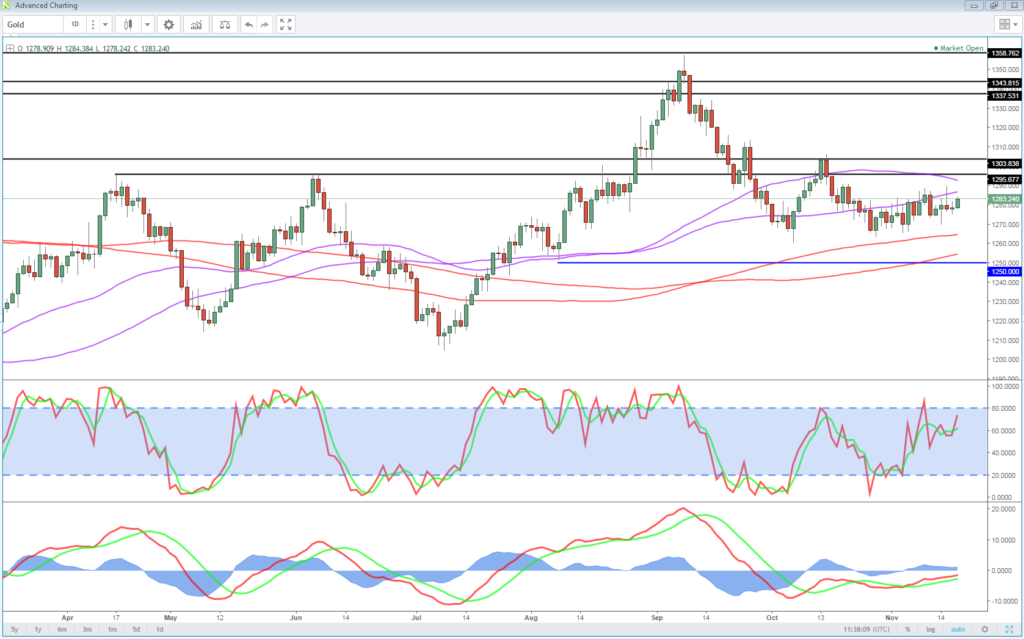

Gold Higher as Traders Shift to Safe Havens

With that in mind, we are seeing some preference for safe haven assets today, with the yen making gains against its major counterparts – USD, EUR and GBP – while Gold is making steady gains after a wobbly few days. The yellow metal though continues to trade in a fairly tight sideways range not far below $1,300, a sign that traders haven’t entirely given up on the traditional safe haven despite the strong risk rally in recent months.

While it’s been a very busy week in terms of economic data and events, Friday is looking much more calm. Canadian CPI and US building permits and housing starts make up the only notable country-specific releases, although we will get rig data from Baker Hughes later in the day.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.