PMIs to Highlight Improving Economic Outlook Across Eurozone

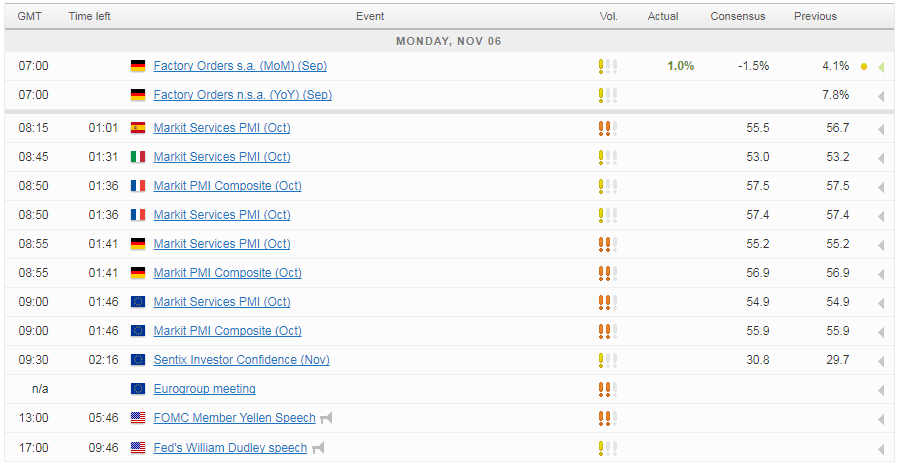

European equity markets are expected to open a little lower on Monday, coming slightly off their recent highs as traders await PMI survey’s from across the euro area.

The services PMIs following the strong manufacturing survey’s last week which suggest activity in the region is likely to improve at a good pace in the months ahead. The improved global economic environment has been very supportive of the recovery in the eurozone and today’s data from the services sector is expected to further highlight that.

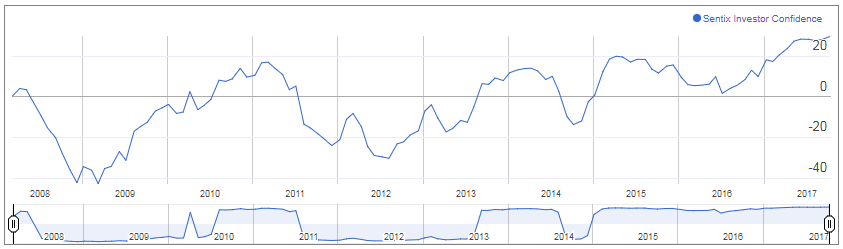

Improvements in the economic outlook is expected to be accompanied by similar advances in investor confidence, with the Sentix survey seen hitting a post-financial crisis high, rising from 29.7 to 30.8. This is particularly important at a time when the central bank is taking its foot off the gas, with there so far being no knee jerk reaction in the markets similar to what we saw in the US in 2013.

This week will likely be a little quieter than last given the absence of quite so many economic events, earnings and significant announcements. That said, we will still get monetary policy decisions from the Reserve Bank of Australia and the Reserve Bank of New Zealand, as well as appearances from a variety of policy makers throughout the week.

Saudi Arabia’s New Sheriff Pumps Oil Higher

Fed’s Dudley to Speak Amid Speculation He is Due to Retire

The first of these will be William Dudley, the Federal Reserve Bank of New York President and prominent voter on the FOMC, who is scheduled to appear later today. While he is scheduled to speak about lessons from the financial crisis, it has been rumoured of the weekend that he is due to be the latest Trump-era casualty at the Fed.

Dudley is believed to be preparing to announce his retirement which would make him the third permanent member to leave his post in recent months, with Chair Janet Yellen’s term coming to an end in February and vice Chair Stanley Fischer having already stepped down. Donald Trump last week confirmed Jerome Powell as Yellen’s successor leaving a number of important positions to be filled, as the President shapes the Fed as per his liking.

Trump Asia Visit Key This Week

Trump’s visit to Asia will be another focal point for investors this week as he prepares for some intense discussions on trade and North Korea with some key US allies. This morning’s press conference with Japanese Prime Minister went as expected, with Trump pushing for fairer trade between the two countries and both maintaining a tough, united North Korea stance.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.