Saudi Arabia’s Crown Prince Mohammed bin Salman’s detaining of many prominent citizens this weekend pumps oil even higher from Friday’s impressive session.

Oil rocketed higher on Friday as the markets negotiated the Non-Farm Payrolls without incident and concentrated on tightening global supplies, ignoring overbought technical indicators. Crude maintained the positive tone in early Asian trading after the Saudi Arabian bombshell over the weekend with multiple arrests of various Princes, Ministers and prominent businesspeople on suspicion of corruption. Crown Prince Mohammed bin Salman is wasting no time in yet another new role as the head of the anti-corruption commission. This Arabian night of the long knives has unsettled markets this mo0rning and should ensure that crude maintains a bid tone over the start of the week.

Brent crude soared 2.30 % on Friday to close at 62.35 and has settled another 0.20% in Asia following an initial spike to 62.60. This provides initial resistance for Brent with the charts showing no more resistance until 66.00 should it break. On the downside, Brent has a triple daily bottom at 60.10 which is crucial support. Trendline support at 58.50 follows it.

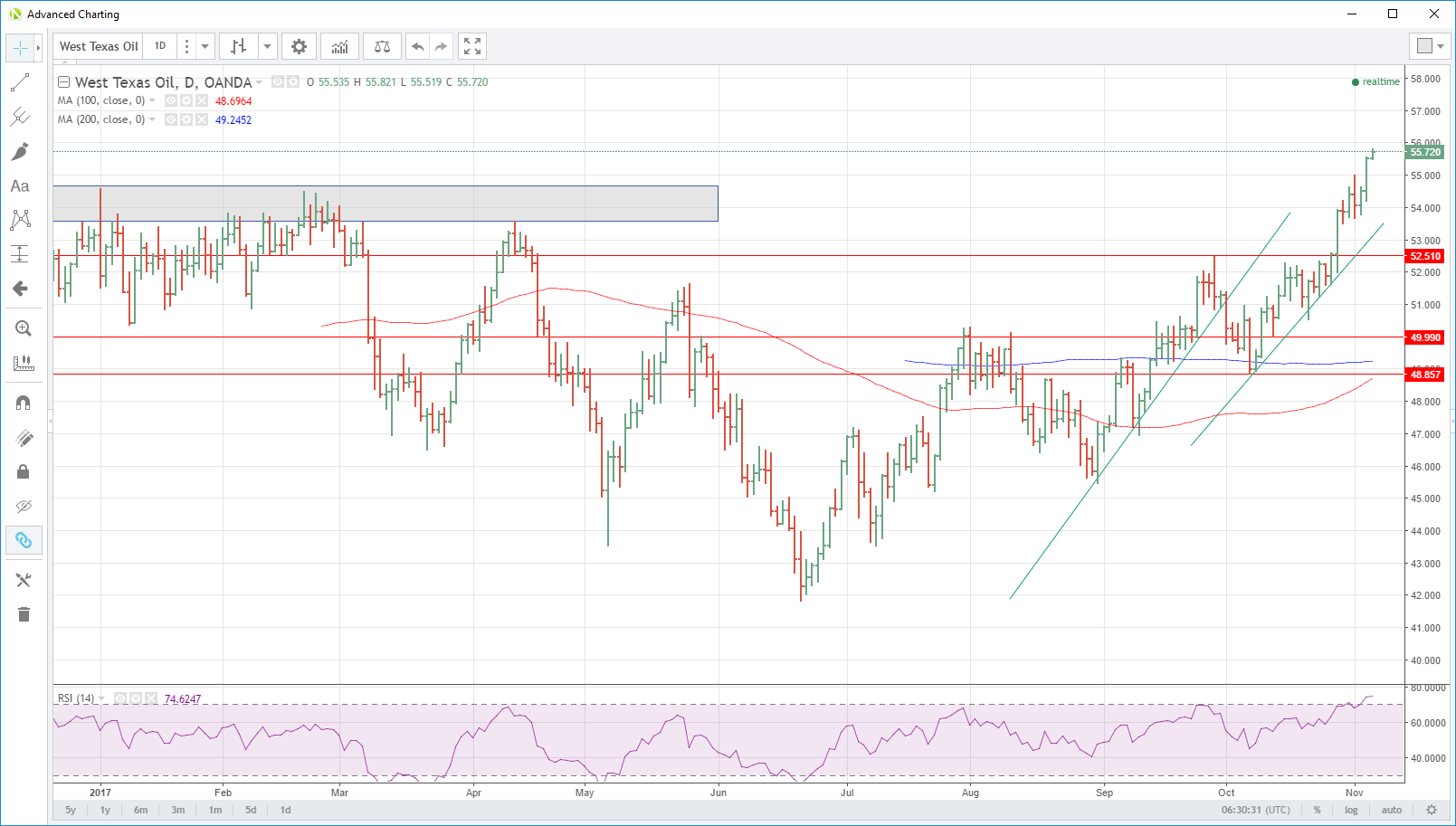

WTI spot climbed an impressive 1.80 % to close at 55.55 on Friday. It has made further upside progress this morning, spiking to 55.80 on its open before settling back to a still positive 55.60. The technical picture suggests that the way is now clear for a run at the 2015 highs around 61.50 although it must negotiate an area of congestion between 57.50 and 60.00 along the way. Support is somewhat distant at a daily triple bottom at the 53.70 area followed by trendline support at 53.10.

Important Note: The RSI’s

The technical Relative Strength Indicators (RSI) indicators on both contracts remain severely overbought in the short-term which suggest bullish traders are playing with fire at these elevated levels. However, the political situation in Saudi Arabia will most likely override these fears in the short-term and maintain the upside bias to crude on geopolitical risk.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.