US Markets Reflect on Major Announcements and Reports

US futures are trading relatively flat ahead of the open on Monday, struggling to gather any real momentum after having recorded all-time high closes again on Friday on the back of decent jobs data.

The jobs data wrapped up a very busy week for financial markets that included a Federal Reserve meeting, new Fed Chair announcement, tax reform and a large batch of earnings reports. With the week ahead looking much quieter, investors will be left to reflect on the events of the last week and determine what it means for markets over the coming months, with a rate hike in December still the base case scenario in most people’s view.

The third quarter earnings season has given investors plenty of reason for optimism and with the global economy as a whole looking more healthy than it has in years, there’s little reason to be pessimistic right now. Of course there is still plenty of risks bubbling away underneath the surface which is likely to leave markets vulnerable at times, but investors seem more than willing to shrug this off for now.

Turkey’s Central Bank Supports Lira

Eurozone Surveys Paint Positive Picture

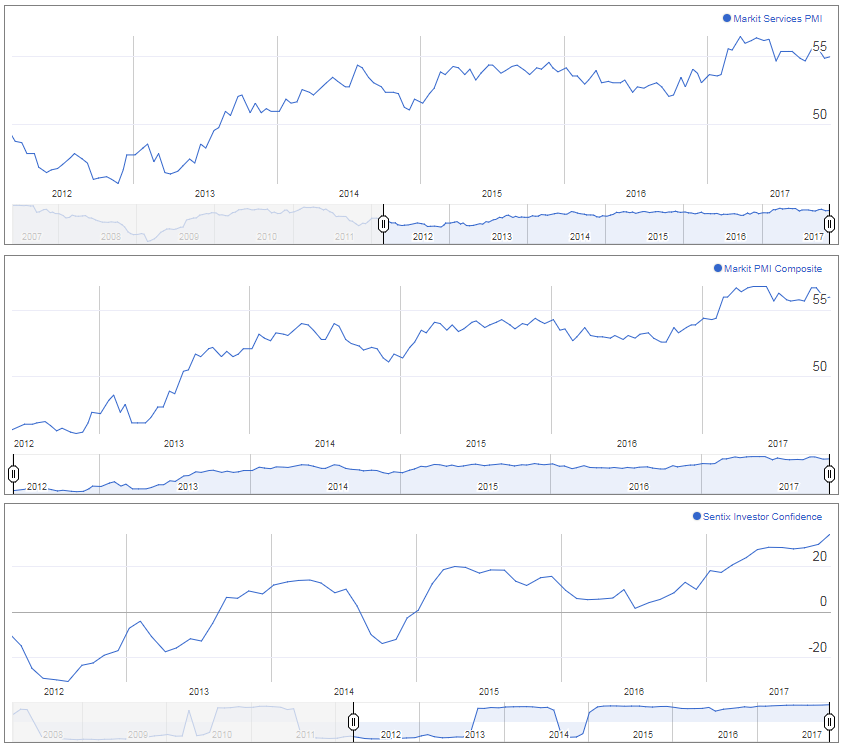

The highlight of the European session so far has been the services and composite PMI surveys, which were broadly mixed compared to expectations but continue to show progress being made. The recovery has been very slow compared to elsewhere but we’re finally seeing it gather momentum which is allowing the ECB to take its foot off the gas.

We did see a significant improvement in euro area investor sentiment in November, more so than was expected, with confidence rising to its highest since July 2007. Overall, the market reaction to the data has been rather muted this morning, with equity markets still trading in the red and the euro pretty much unchanged against the dollar, albeit with a small bump higher around the Sentix release.

Dudley to Appear as Speculation Grows Regarding His Future

From a US perspective, the week is looking rather quiet both in terms of economic data and earnings, with the reporting season now drawing to a close. The most notable events this week will likely be Donald Trump’s Asia visit and appearances from a number of Federal Reserve officials. The first of these today will be William Dudley who is believed to be preparing to announce his retirement, if speculation is to be believed. This will create another spot on the board of Governors, enabling Trump to further put his mark on the central bank.

Saudi Arabia Jitters Reprieve Gold and Silver

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.