Jobs Report Eyed as Fed Gets New Chair

It’s been a very busy week for financial markets in which the Bank of England has raised rates for the first time in a decade, Donald Trump has elected a new Fed Chair and his long awaited tax reform has been unveiled, among many other things.

The US jobs report is widely regarded as the most important economic report each month and yet, in a week that’s been packed full of other major announcements, it’s not attracted the same kind of attention it usually would. Still, with the Fed now poised to raise interest rates again in December having passed up the opportunity to earlier this week, focus will be on the jobs data for signs of weakness.

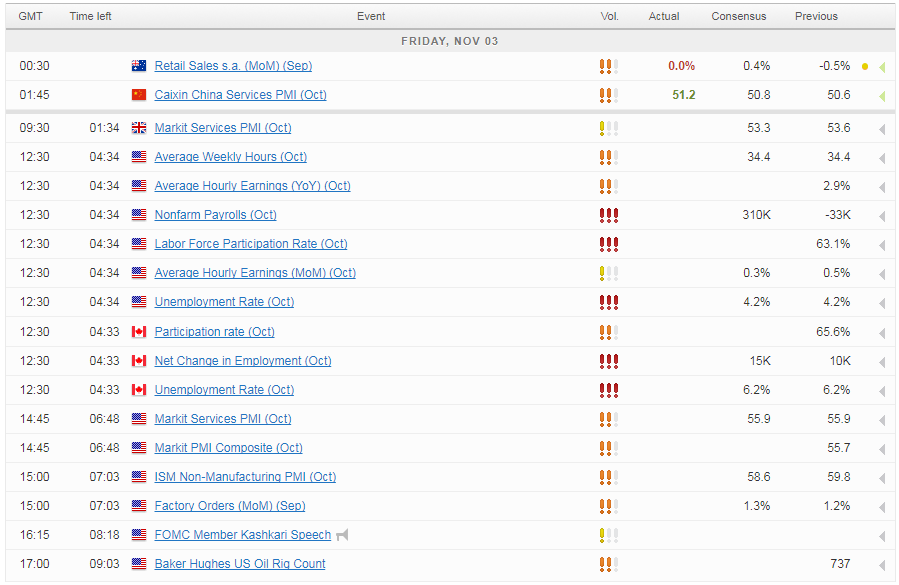

As has been the case for quite a while now, the job creation and unemployment figures will likely draw the immediate attention of traders and could even trigger the early moves in markets, but it’s the wages that will likely have a larger influence on Fed policy. An unusually large number of jobs is expected to have been created last month – 312,000 – which follows the decline the month before following the hurricanes in September. While this rebound in jobs will come as a relief, it’s unlikely to trigger the same kind of move that it normally would in the absence of the previous month’s decline.

The appointment of Jerome Powell to succeed Janet Yellen as Fed Chair is widely regarded as a continuity play by Trump, which means markets are still behind the curve when it comes to US rate hikes next year. With other spots on the Board of Governors still up for grabs, Trump’s other appointments may offer more insight into the future direction of the Fed but this should give a good indication of the direction he’s headed. With that in mind, wages should be important today as improvements here could offer the clearest indication that inflation will follow.

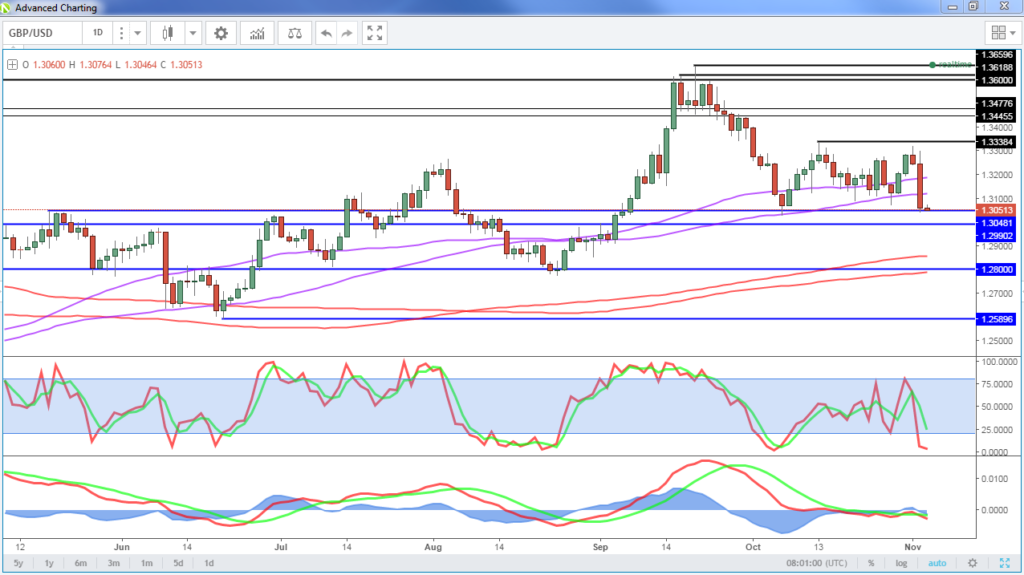

GBP Vulnerable Ahead of Services PMI Data

The European session will likely be a little quieter this morning, with the only notable data being the services PMI from the UK. The services sector is hugely important for the UK economy, accounting for more than three quarters of total output, which would explain why GDP has slowed in recent quarters in line with the decline in this figure despite other areas, such as manufacturing, having improved.

The pound may be vulnerable to further downside today in the event of a weaker reading, having fallen more than 1% following yesterday’s rate hike. The increase itself was almost entirely priced in but traders were clearly not prepared for the dovish statement that accompanied it triggering some profit taking. A weaker PMI number today could see 1.30 come under pressure in GBPUSD.

OANDA fxTrade Advanced Charting Platform

Dollar Weaker Ahead of US Jobs Report

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.