Gold tumbles as the U.S. Senate causes yields and the dollar to rise across the board.

Gold has fallen 0.50% or some six dollars from its close in New York as Asia erases almost all of the gains it made yesterday. Gold is wilting as the U.S. dollar surges in Asia after the U.S. Senate adopted an FY18 budget resolution. It has seen Treasury yields edge higher pushing the dollar up across most currencies with the US Dollar Index higher by 0.40% in Asia. Along with the odds of the new Federal Reserve Chairmen shortening to make a more hawkish Jerome Powell the frontrunner, none of this is good news for gold.

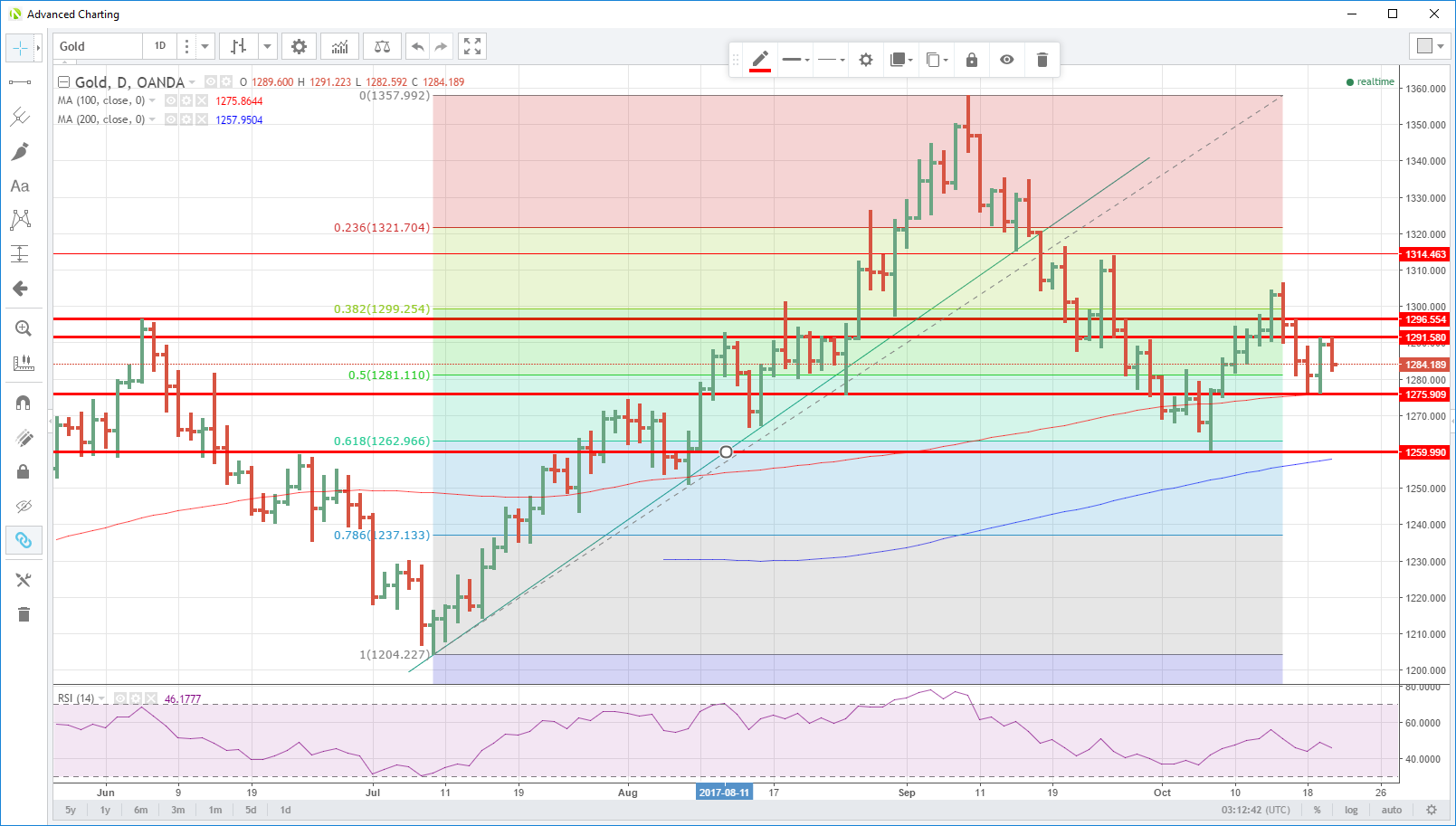

Having closed at 1289.00 gold is now trading at 1283.50 with double top resistance at 1291.30 followed by the 1296.00 area. Significant support, however, is just below at 1276.00, a double bottom from Wednesday and Thursday and also the 100-day moving average. A break would open up further falls to the 1260.00 regions and the nearby 200-day moving average at 1258.00. It would most likely a significant rush for the exit door by traders if it were to give way.

The key to the remainder of the session is whether the U.S. dollar gains and higher Treasury yields are sustained into Europe and New York. If the moves correct then gold may get a reprieve, if Europe continues to run with this baton, it could be a long day for bullish gold traders.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.