UK Data Likely to Highlight Tough Job Facing BoE Policy Makers

European markets are poised to open a little higher on Wednesday, as we await the latest labour market data from the UK and speeches from ECB and Federal Reserve policy makers.

The UK is a key focus for markets this week as traders try to determine whether or not the Bank of England will follow through on warnings that interest rates could rise at an upcoming meeting. Comments on Tuesday from Governor Mark Carney and two of his new colleagues on the MPC highlighted how close and tough the decision is, given the unfavourable economic outlook.

The API Keeps Oil Near its High

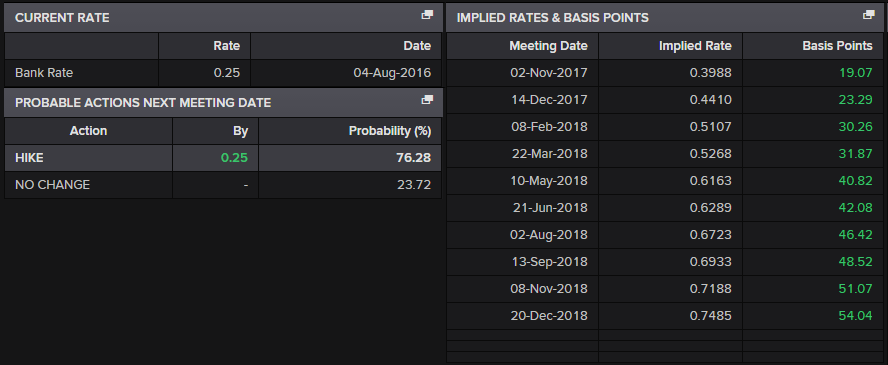

The September inflation data likely didn’t have much of an impact either way, with policy makers that were previously on the fence probably still perched up there now. With a hike next month now 76% priced in by markets according to Reuters, traders clearly need little convincing although I’m not convinced it’s that straightforward.

Source – Thomson Reuters Eikon

The labour market figures this morning will likely be closely monitored in the absence of any clear assistance from the CPI data. Once again though, the unemployment data is expected to paint one picture with the rate remaining at 4.3% while average earnings paints an entirely different one, as wages rise by only 2.1%. Negative earnings growth is one of the factors that is likely to weigh on the economy going forward and makes the BoE’s decision on interest rates all the more difficult.

OANDA fxTrade Advanced Charting Platform

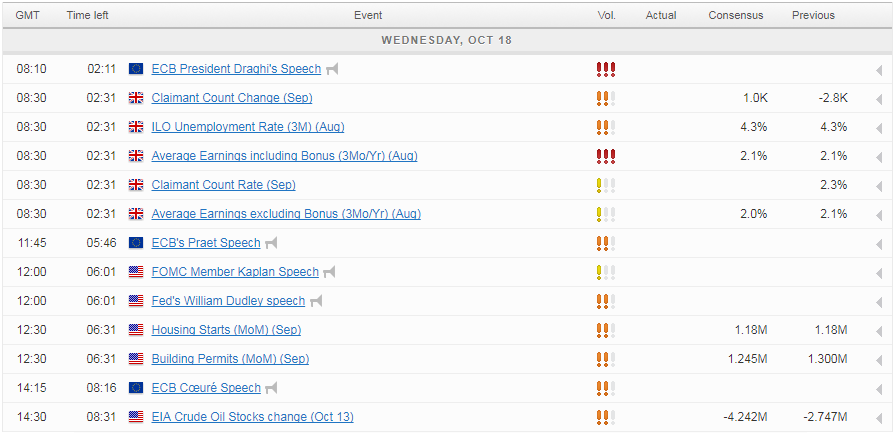

Draghi and Praet Comments Eyed as ECB Plans to Withdraw More Stimulus

Speeches from ECB President Mario Draghi and Chief Economist Peter Praet will also be closely followed today for hints at how the central bank will manage the process of reducing new asset purchases to zero over the next year or so. The ECB is expected to make an announcement next week, with the consensus reportedly favouring a €30 billion reduction until September, likely followed by a reduction to zero thereafter. Although given the cautious nature of the central bank, that is not something they will likely commit to or possibly even allude to even though the intent will be clear.

Dudley and Kaplan Make Appearances as Speculation Grows Around Yellen’s Replacement

The Federal Reserve is never too far away from the spotlight, especially when President Donald Trump is interviewing candidates to succeed Janet Yellen when her term ends in February. The dollar has caught a bid in recent days following reports that Trump was impressed when interviewing John Taylor, who is seen as being more hawkish than Yellen. Who will replace Yellen, assuming her term isn’t extended will likely remain a hot topic and in the meantime, we will hear from a couple of her colleagues, Robert Kaplan and William Dudley, as the central bank prepares to raise rates one more time this year.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.