The US dollar made a comeback on Wednesday after the Fed stood by its previous belief that interest rates will rise once more this year.

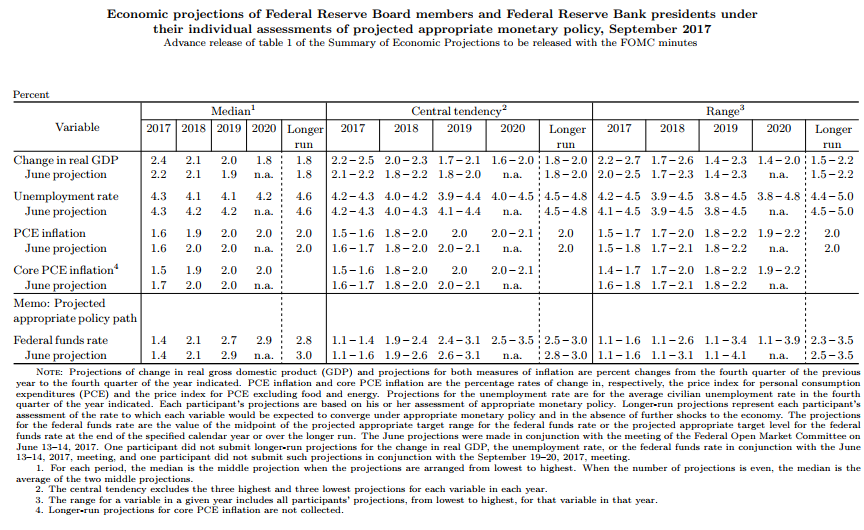

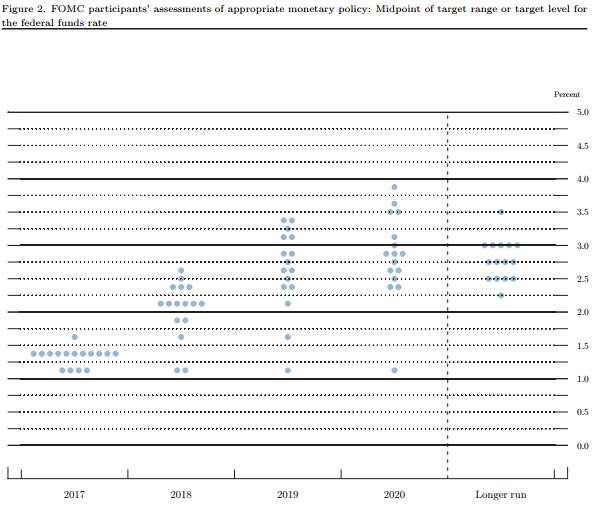

Markets have been increasingly pricing this out in recent months with inflation data, Fed commentary and the recent economic impact of hurricanes among the reasons for this. The Fed though remains undeterred and only marginally revised lower projected Fed funds rate for 2019.

Source – Federal Reserve

The dollar – which for a while has looked extremely stretched having fallen more than 10% from its peak at the start of the year – rallied quite aggressively after the release of statement and projections and has stabilised near its highs throughout Chair Janet Yellen’s press conference.

Whether these moves will be maintained we’ll see over the next few days but with a number of dollar pairs having already stumbled, there is potential for an arguably long overdue dollar correction to take place. The ECB will probably be more relieved than anyone, with suspicious “sources” releasing statements every time the EURUSD pair reached 1.20, clearly a sign that the central bank does not like this level. With it back below 1.19, at least for now, the ECB will likely be much more content.

OANDA fxTrade Advanced Charting Platform

The hawkish Fed position weighed on Gold which fell back below $1,300 for the first time since August. With geopolitical risk subsiding, at least for now, and the Fed maintaining its view on interest rates, Gold below $1,300 may become the norm once again.

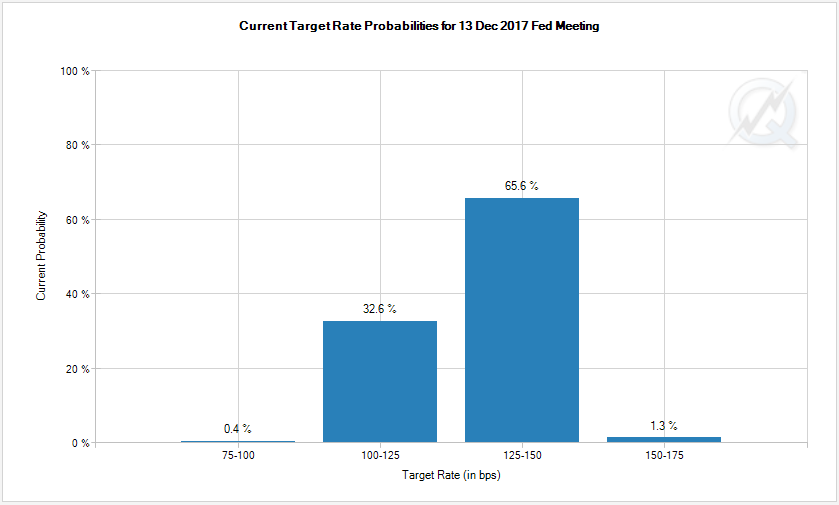

US Treasuries also jumped to their highest since early August as the probability of a rate hike jumped to around 67%.

Source – CME Group FedWatch Tool

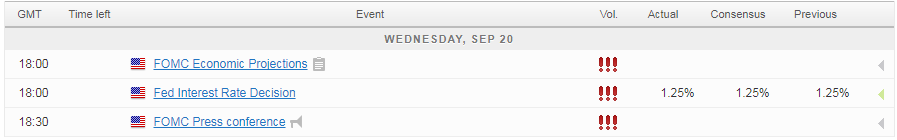

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.