Geopolitical Risks Remain Despite Period of Calm

It would appear that a running start to the week and fresh record highs in the S&P 500 has proven a little much for some traders, with profit taking seen ahead of Wednesday’s open.

Naturally there is still plenty of underlying geopolitical risk in the markets at the moment, even if acts of provocation have decreased and become less hostile, and this is likely to put a cap on risk rallies for now. The longer this period of calm continues, the more relaxed investors will become which will be better for riskier assets, while safe havens will continue to experience unwinding. Gold is a perfect example of this having come off its highs while remaining at elevated levels.

DAX Unchanged as German Inflation Reports Within Expectations

Negative UK Wage Growth Creates Dilemma For BoE

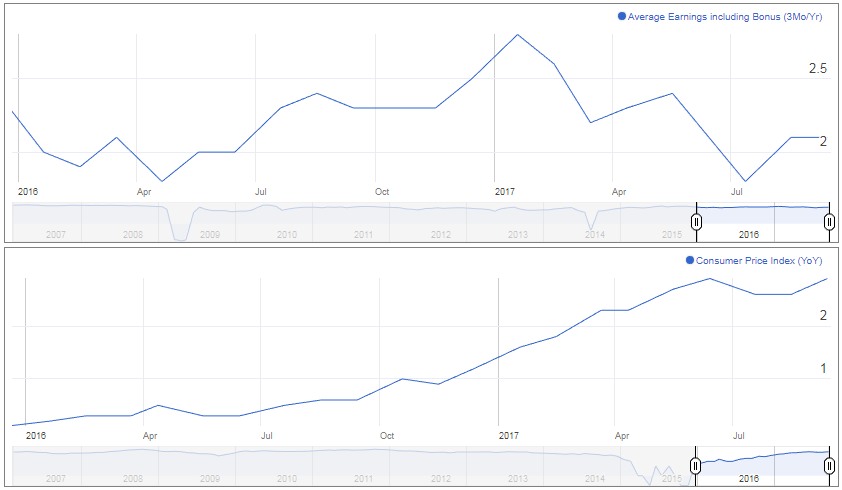

The British pound got off to a good start on Wednesday, building on Tuesday’s impressive gains which came on the back of stronger than expected inflation data, before labor market figures got in the way. Unemployment in the UK fell to its lowest level since June 1975 in the three months to July in an apparent sign that the labor market is tightening and yet, wage growth remained subdued at 2.1%, falling short of market expectations.

To put this into context, inflation last month rose by 2.9% which means real wage growth remains negative. Rising wages alongside prices would suggest that there is potential for higher inflation to become more ingrained in the economy but in the absence of this, the Bank of England can afford to look past the temporary currency driven spike and avoid putting additional pressure on household finances. Whether it will or not when it meets tomorrow is another question.

The rally in the pound over the last week or so and the moves after yesterday’s CPI release would suggest traders are pricing in an increasing likelihood of a rate hike over the next 12 months. Should any more policy makers join Ian McCafferty and Michael Saunders in voting for a rate hike tomorrow – such as Andy Haldane who’s previously indicated he may be tempted – then the pound could head higher once again.

OANDA fxTrade Advanced Charting Platform

Oil Inventories Eyed After API Report

With the two most notable US data releases this week due tomorrow and Friday, focus will shift to oil now as we await the latest inventory data from EIA. A 2.285 million barrel increase is expected for last week which is well short of the number reported by API on Tuesday evening leaving the potential for some upside surprise.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.