EURUSD Rallies as Draghi Leaves Tapering Door Wide Open

ECB President Mario Draghi did everything he could today to put a dovish slant on a central bank that’s actively pursuing less monetary stimulus but as we’ve seen before, traders were not interested in what he had to say, it’s what he didn’t say that was important.

The euro was already rallying in the lead up to the ECBs monetary policy announcement and Draghi’s press conference, displaying a confidence in how both would play out. Once again today, the ECB was keen to stress that QE could be increased in both size and duration should the economic outlook warrant it, rather than stating what is likely to happen under the current circumstances.

CAC Gains Ground Despite Dovish ECB Statement

It’s clear, as Draghi repeatedly mentioned, that policy makers are concerned about the strong and rapid appreciation that the currency has experienced, which is probably preventing them from making a tapering announcement at this time. The problem they face is, in not talking about tapering or, more importantly, suggesting that the program could be extended as it is beyond the end of the year, they are effectively confirming that tapering will happen. Or at least, that’s how traders are perceiving it.

What’s interesting is that, once the volatility passed – and we saw extreme volatility in the opening minutes of Draghi’s press conference – the euro rallied as high as 1.2059 against the dollar, just shy of the 29 August high, before profit taking set in. The failure to make a new high is a sign of an overheated market. At the same time, the pair has since fallen back to trade below 1.20 which could be another sign that the rally has run its course for now.

OANDA fxTrade Advanced Charting Platform

Another failure to end the day above 1.20, despite having traded significantly above there on two occasions, would strongly suggest the psychological resistance is in play. Draghi may have failed to convince traders that the ECB is in fact dovish but he may have stumbled upon a natural barrier to the upside in the process, at least for now.

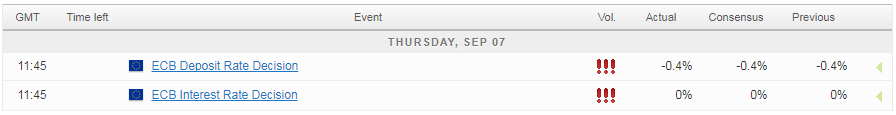

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.