Risk Appetite Improving But Caution Remains

Risk appetite is gradually returning in financial markets but underlying caution remains, with investors not expecting tensions between the US and North Korea to subside any time soon.

The expectation that a diplomatic solution will not be found in the near-term is likely to result in underlying caution remaining for now. With more flare ups likely, I expect we’ll see repeated episodes of safe haven flows, which should mean Gold, the Swiss franc and the yen (barring any attack on Japan) remain well supported. As far as today is concerned, we are seeing a slight unwinding of some of these while the yen remains well bid.

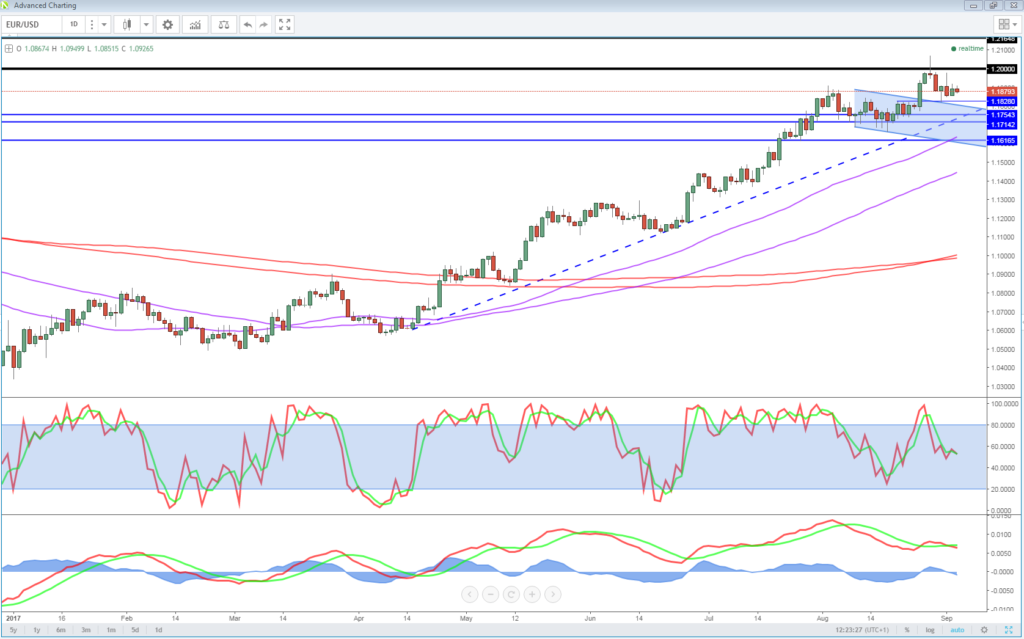

EUR/USD – Euro Ticks Higher as Services PMIs Steady

EUR and GBP Steady After Services PMIs

Economic data from across Europe this morning has done little to stimulate the euro or the pound, both of which are trading modestly higher on the day against the dollar. Services PMIs from across the region were broadly in line with expectations, if not a little on the weaker side, but this hasn’t discouraged traders as in each case, they remain in very positive territory.

OANDA fxTrade Advanced Charting Platform

Draghi Looking For Help From Fed Policy Makers Today

2017 has been very kind to the euro, if not the ECB which is clearly very uncomfortable with the strength of the currency. With 1.20 showing itself to be a notable resistance zone and a level at which the central bank is not comfortable with – as the timing of the ECB sources comment on tapering demonstrated on Friday – I wonder whether a correction is in store for the pair. Today’s PMI numbers may not have triggered this but another failure to break 1.20 may see some bulls start to abandon ship. Alternatively, a dovish Draghi may do the trick, should he choose to go down that path.

That’s assuming Federal Reserve policy makers don’t do the ECB a favour later today, which I doubt they will. Three policy makers are scheduled to appear today including Lael Brainard, Robert Kaplan and Neel Kashkari – all three of whom are voting members on the FOMC. They also represent an interesting mix with Kashkari being arguably the most dovish member of the policy committee, Kaplan falling somewhere in the centre and currently unconvinced about another hike this year and Brainard also a dove. Under the circumstances, it seems unlikely that any will be doing Draghi any favours.

Dollar’s Muted Moves Despite N. Korean Concerns

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.