Friday to Cap Off Another Eventful Week For Markets.

The week started with a missile launch from North Korea and tropical storm in the US but attention has gradually been diverted to the fundamentals, with numerous pieces of data being released over the last couple of days. Risk appetite has gradually improved throughout the week following a rather shaky start, which is normal during periods of heightened geopolitical risk, but the data we’ve seen has been a bit of a mixed bag.

US Jobs Report Today’s Main Event

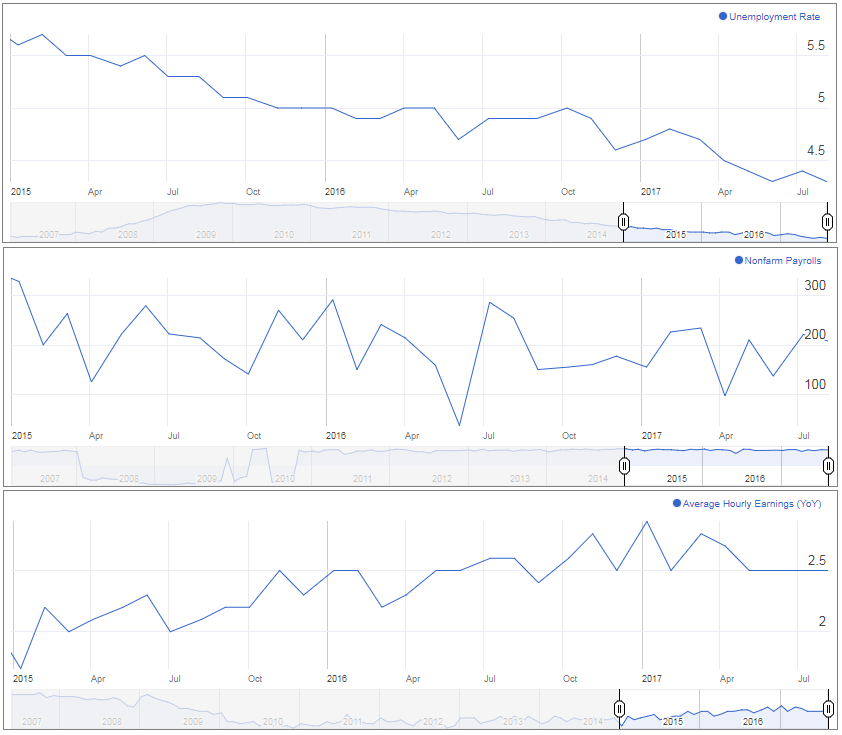

The US jobs report headlines today’s releases but with yesterday’s inflation numbers once again highlighting the subdued price pressures in the country, you wonder how great an impact today’s numbers will have on the Federal Reserve. The central bank has already achieved its target of maximum employment, at least as far as the headline figures suggest, and yet inflation has been gradually declining this year – as per the core PCE price index. This is also happening despite the dollar index having fallen almost 10% since the start of the year to hit its lowest since the start of 2015.

USD/CAD Canadian Dollar Higher After Strong Q2 GDP

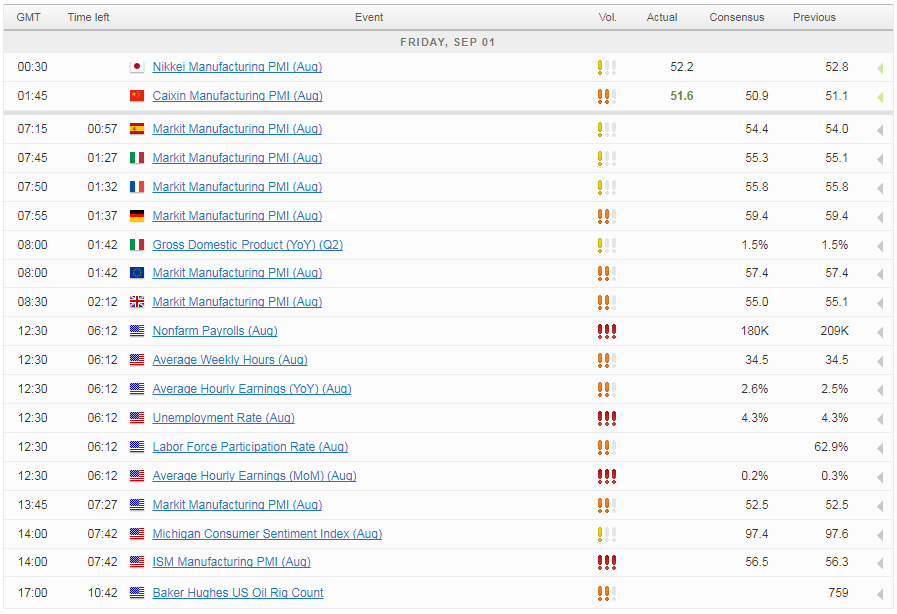

Still, the jobs data does tend to generate a lot of hype and therefore volatility and I expect the same will be the case today. While the most important release at the moment is the average earnings number – as without improvements here, the Fed’s 2% target will be difficult to achieve – it’s the NFP and unemployment figures that tend to grab traders attention initially. Market expectations are for 180,000 jobs to have been created last month leaving unemployment at 4.3%, although it should be noted that ADP reported 237,000 on Wednesday. While not always accurate, the number may suggest expectations are far too low.

Eurozone PMIs Could Provide a Further Headache for the ECB

Prior to this, we’ll get manufacturing PMIs from across the eurozone this morning. While these are revised figures, which typically means the market impact is lessened, the improvement in the economy and confidence in the recovery has been impressive. With the euro trading around its highest levels in more than two and a half years against the dollar, inflation building – albeit from low levels – and the ECB considering tapering, traders may be watching today’s figures quite closely. The euro is potentially looking a little overbought at the moment and responses to the data can often provide a signal of this.

Ahead of the European open, markets are trading relatively flat and equity markets are expected to open in much the same way. It will be interesting to see whether weekend risk is seen as we head into the close today, given the heightened geopolitical risk environment.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.