US equity markets are poised to open a little lower on Thursday, tracking similar moves in Europe earlier in the day as traders absorb Wednesday’s FOMC minutes and await more data from the world’s largest economy.

Dovish Fed Minutes Halt Equity Rally

The minutes highlighted the growing divide that is appearing within the Federal Reserve with respect to interest rates. There appears to be a united front when it comes to reducing the balance sheet – which now looks increasingly likely to start in September – but traders currently appear unconcerned by this. The debate on the third interest rate of the year has been happening for some time outside of the Fed, which is why markets have never priced it in as much as the other two. The fact that it’s now happening within the Fed won’t improve those odds.

USD and Treasury Yields Slip After Minutes

The US dollar felt the brunt of it initially, with the yield on US Treasuries also coming under pressure as markets continue to price in a slower pace of tightening going forward. With markets being relatively unresponsive to reductions to the balance sheet, policy makers may see this as the preferred method of “tightening” for now until inflation returns to a more acceptable level and shows signs of rising towards target.

Source – Thomson Reuters Eikon

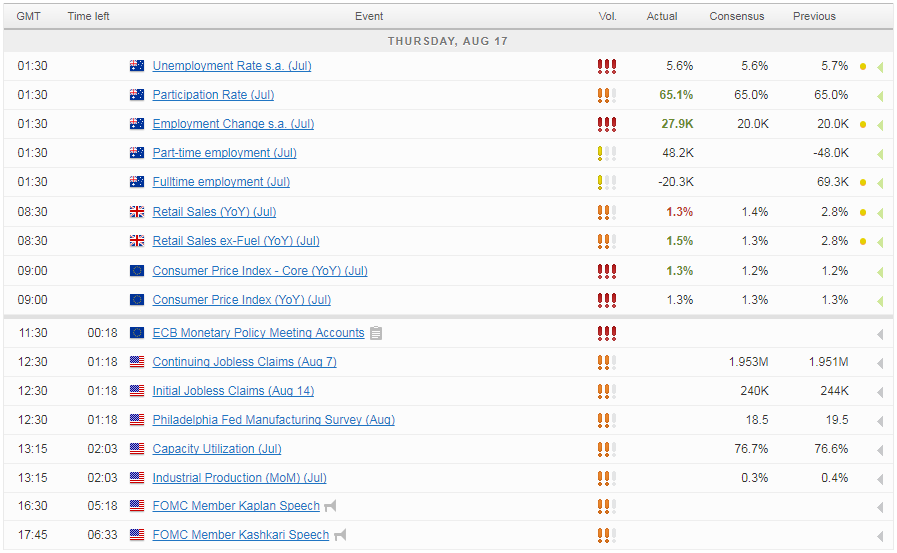

It will be interesting to hear the views of Neel Kashkari and Robert Kaplan later in the session, with both FOMC voters scheduled to appear. While Kashkari is arguably the most dovish on the committee, Kaplan is one of those that have shown a willingness to wait for more inflation data before raising rates again so his views will be particularly interest. There’s also a number of pieces of data being released on Thursday, including jobless claims, Philly Fed manufacturing index, capacity utilization and industrial production.

ECB Accounts Could Offer Taper Clues as Core Inflation Rises

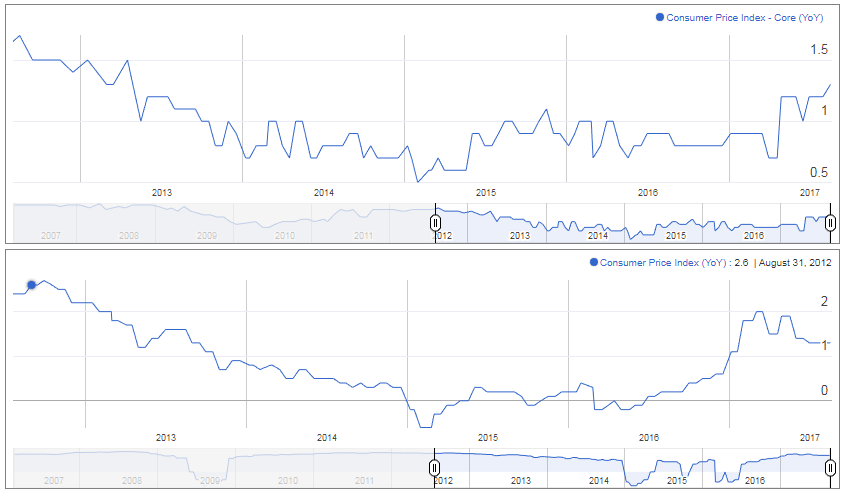

Another central bank looking to carefully reduce accommodation is the ECB, which is due to release accounts from its July meeting today. Traders will be looking for clues regarding its bond buying, with the current program due to expire at the end of the year. The ECB is widely expected to announce another reduction and extension to the program, possibly at the September meeting, but along with its peers, it faces difficulties due to inflation running well below target.

Gold Soars As Oil Is Sent To The Naughty Corner

Today’s numbers did little to ease the burden, with the final figures for July showing prices rising only 1.3%, both on an overall and core basis. The core number represented a slight upward revision from the preliminary number but this failed to lift the euro, with traders seemingly viewing it as not being enough to guarantee another taper.

Still, while overall inflation has fallen since the start of the year, core inflation has been on a gradual upward trajectory, which will be encouraging to policy makers and may give them the green light to taper.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.