Following the lead from Asia, European equity markets are poised to start the week on a positive note with sentiment buoyed by the absence of any escalation in the ongoing feud between the US and North Korea.

Traders Relieved as Weekend Brings No Further Geopolitical Risk

The war of words between the two countries weighed heavily on risk appetite for much of last week and despite today’s bounce, it will continue to pose a threat in the days ahead. What we’re seeing today is relief at the situation not deteriorating over the weekend, something traders were clearly wary of towards the end of last week.

Still, given the unpredictability of those involved, traders are likely to remain on edge and I don’t think it will take much for the safe haven rush to resume. In the meantime, we’re seeing a small unwinding of those risk aversion trades, with Gold trading slightly lower and the yen and Swiss franc off against the dollar, pound and euro.

FOMC’s Song Drowned By Don and Kim

JPY Slips Despite Very Encouraging Q2 GDP Data

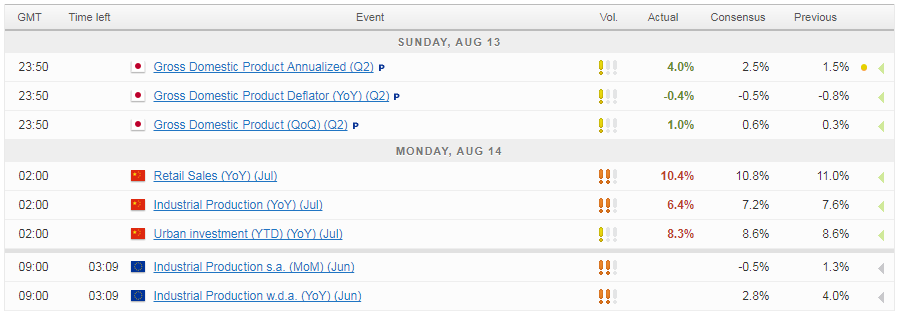

The yen’s losses come despite far better than expected second quarter GDP data being released overnight. A 1% quarter on quarter increase – 4% on an annualised basis – blew away expectations and was particularly encouraging as it was strongly driven by much better consumer spending and capital expenditure, both of which were double what was expected.

OANDA fxTrade Advanced Charting Platform

If Japan can carry this momentum into the second half of the year, the Bank of Japan may be able to consider whether less accommodation is necessary, although as it stands, inflation still remain well below target.

Chinese Data Disappoints at the Start of Q3

The data out of China was far less encouraging, with retail sales, industrial production and fixed asset investment all falling well below expectations. The Chinese economy has expanded at a very good pace so far this year, spurred on by fiscal stimulus – which is expected to slow in the second half of the year – and external demand. These numbers are perhaps a reflection of what we can expect over the next couple of quarters, with infrastructure spending likely to cool. The most concerning aspect is probably retail sales for that reason, with this being seen as the area that’s meant to fill the void.

Today is looking a little quiet on the data side which means traders will remain focused on geopolitical developments. There is a lot more data to come over the course of the rest of the week though so things will certainly pick up.

A Weekend Risk Reprieve; But No Rest For the Wicked

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.