Central banks are likely to remain a key focus for investors this week, with the sudden hawkish shift among a number of them in recent weeks pushing bond yields higher and weighing on risk appetite.

Will There Be Any Substance to BoC Hawkish Warnings

This sudden and seemingly coordinated move from a number of central banks including the ECB, Bank of England and Bank of Canada, caught investors a little off-guard, forcing them to start pricing in a tightening of monetary policy that previously appeared very unlikely. We’ll see just how much substance there is to these comments on Wednesday, when the BoC announces its latest decision, with investors now expecting a 25 basis point increase.

It’s not exactly clear why we’ve seen a sudden change of heart from central banks all of a sudden but it seems clear that something has spooked them into action and should they follow through, further tightening may need to be priced in. While the impact of this hasn’t weighed too heavily on equity markets so far, it does appear to have taken the edge off the rally and may continue to do so in the coming months.

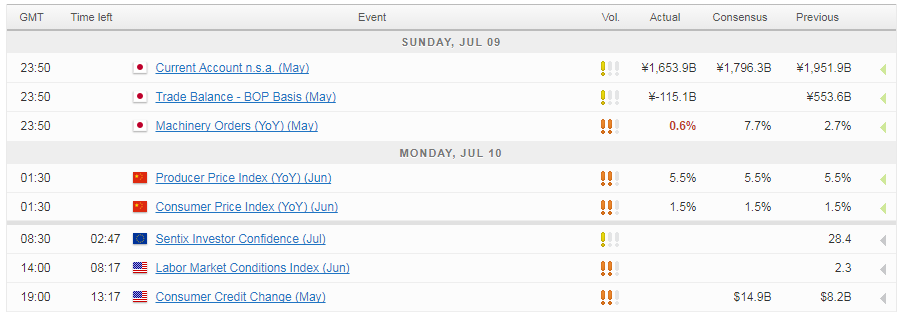

A number of policy makers across the major central banks are scheduled to appear throughout the week, which under the circumstances will likely draw a lot of attention. Monday will be a little quiet though on that front, with only John Williams of the Federal Reserve – a non-voter this year – scheduled to appear. Instead we’ll have to focus on the data, with eurozone investor confidence and US labour market conditions and consumer credit numbers due to be released.

Oil Pares Losses But Remains Under Pressure

Oil has started the week on a positive note, trading around 1% higher overnight, although this is perhaps nothing more than a little profit taking with Brent and WTI falling that 7% from last week’s high at one stage.

Week Ahead Dollar Rebounds on Strong Jobs Report

Yen Stumbles Again After Weaker Data, With BoJ Bond Buying Also Weighing

The yen is under pressure once again, with softer machinery orders and current account data chipping away at the currency. This also comes after the Bank of Japan took the opposite stance to other central banks and increased its bond buying last week in an attempt to offset higher yields.

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.