US equity markets are expected to open relatively flat on Friday, with bond yields back in focus as we await the June labour market data from the US and Canada.

Higher Bond Yields Weighing on Equity Markets

Bond yields have been rising once again this week as investors continue to prepare for the prospect of less monetary accommodation from central banks around the world. Recent commentary from a number of policy makers has done nothing to alter people’s views, if anything they’ve supported them. While it seems an odd time for such coordinated moves, something has clearly spooked policy makers and triggered this change.

The moves in bond markets appear largely responsible for the stalling stock market rally and is likely what’s weighing on them once again today. Still, it’s important to note that we’re still far from correction territory in the vast majority of indices, even the NASDAQ which has been hit particularly hard by the tech sell-off. There’s certainly no reason to panic at this stage and the moves could prove to be nothing more than a temporary adjustment.

Non-farm payrolls: A boon or bust for the Dollar?

It’s not even certain in some cases whether central banks will follow through on their warnings. We’ll see the first test of this next week when the Bank of Canada announces its decision on interest rates. The ECB has long been expected to reduce its bond buying again at the end of the year, while the Fed’s position has not changed and the Bank of England may still hold off, given the Brexit uncertainty that’s hanging over the economy.

Wages Key in US Jobs Report, Canadian Data Also Key Ahead of BoC Decision Next Week

With central banks in mind, focus will now shift to the economic data for a fundamental justification for tighter monetary policy. It’s jobs report day in the US – widely viewed as the most important economic report for the world’s largest economy – and people will be looking for signs that the labour market remains on track but, arguably more importantly, that wages are rising. Higher wages will be the clearest sign yet that inflation is likely to pick up in the future but we haven’t seen the tighter labour market reflected here yet. Canadian jobs data will also attract a lot of attention ahead of next week’s BoC decision.

DAX Ticks Lower, Markets Await US Nonfarm Payrolls

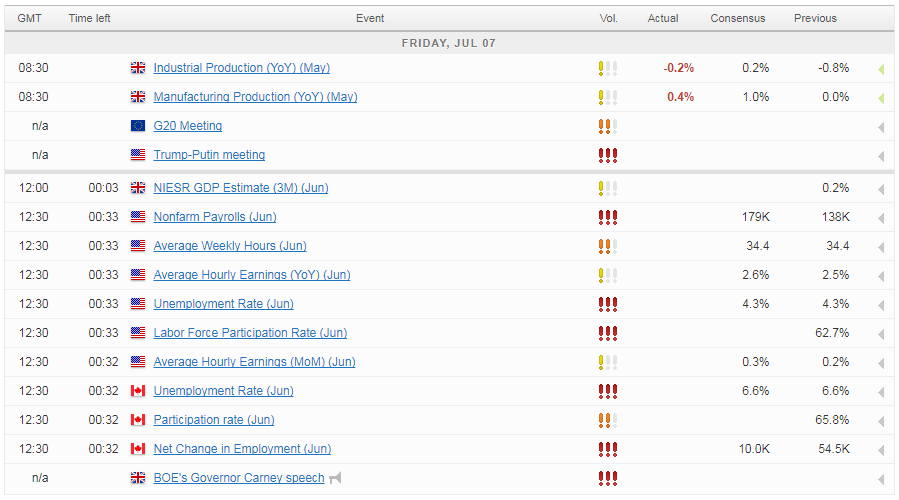

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.