European equity markets are expected to bounce back after a disappointing start to the week, with futures pointing to a slightly higher open on Tuesday.

The quiet start to the week in terms of news flow and economic data combined with the UK election result didn’t provide much reason for optimism on Monday, although it was the sell-off in tech that appeared to be the greatest drag. Whether this is a temporary correction in a sector that has performed extraordinarily this year or something more is yet to be seen but nothing suggests to me that the latter is the case.

The Loon ruffles some feathers

UK CPI Key Ahead of Thursday’s BoE Decision

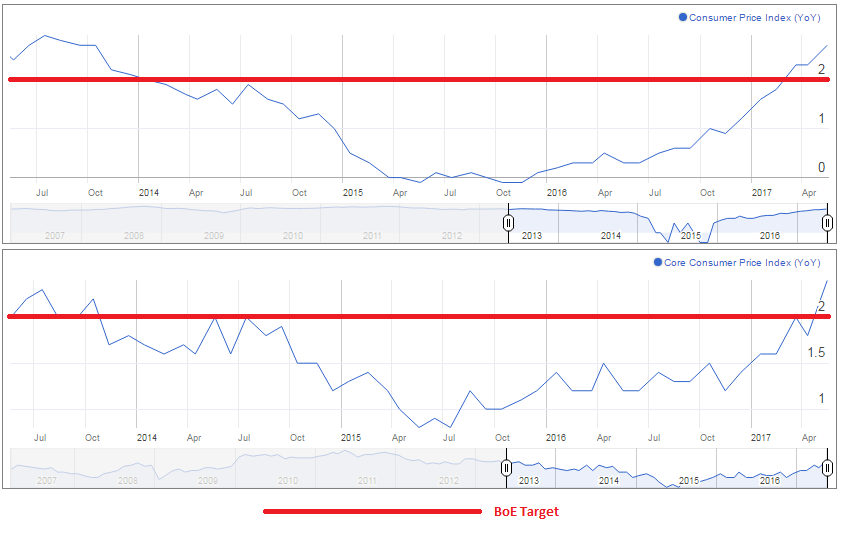

While the bulk of this week’s key events kick of tomorrow with the Federal Reserve announcing its latest monetary policy decision – and most likely its second rate hike of the year – there are some notable releases today that could shake things up a little. UK CPI inflation for May will certainly be of interest ahead of Thursday’s monetary policy decision, even if any change in interest rates appears extremely unlikely.

Given the political uncertainty hanging over the UK as it prepares to begin Brexit negotiations with the EU, it seems very unlikely that policy makers would deem it an appropriate time to add a rate hike into the equation unless it deemed it absolutely necessary. It’s given the impression in the past that it’s willing to look beyond any minor overshoots in inflation driven by a weaker currency and higher oil prices but with headline inflation seen remaining at 2.7% and core at 2.4%, you have to wonder how much more they’ll stomach. Any surprise increases could give policy makers something to think about in the months ahead.

Political Uncertainty Leaves GBP Looking Vulnerable

The political situation in the UK will likely remain at the forefront of people’s minds today. While Prime Minister Theresa May appears determined to move past the humiliation of election night and get on with forming a government and beginning Brexit negotiations, and many lawmakers appear to support her in public at least, I think there’s some way to go before people believe the country has anything that resembles stable leadership.

GBP/USD – Election Fallout Sends Pound Lower

While that uncertainty hangs over the country, the pound may continue to look vulnerable as it lingers around its post-election lows. A break below 1.26 against the dollar could trigger another decline in the pair, with 1.24 perhaps being its next notable level.

OANDA fxTrade Advanced Charting Platform

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.