US equity markets look likely to test their all-time highs on Thursday, with the S&P 500 on course to open at record levels and the Dow not far behind. The focus this morning has been on oil and UK markets, with OPEC making statements on the proposed oil cut extension and UK growth figures disappointing in the first quarter.

Buy the Rumour, Sell the Fact – Oil Hit on Cut Extension Comments

Brent and WTI got crushed earlier as energy ministers from within OPEC suggested that an extension will be agreed and will likely be at the same levels for six or nine months. It’s been a classic case of markets buying the rumours and selling the facts. It would appear a nine month extension with the potential for deeper cuts was almost fully priced in so when the statements were made, there was nowhere left for prices to go but lower.

OANDA fxTrade Advanced Charting Platform

We’ve seen this kind of action time and time again. Traders buy on anticipation of the deal and when its delivered as expected, they take their profits and run. The unwinding of the positions, probably combined with some speculative selling, is what creates this sudden plunge. Prices have rebounded a little following the initial sell-off but remain below the pre-statement levels. With the Saudi Energy Minister confident that stocks can now fall back to their five year average by the first quarter of next year but open to another extension if needed, it will be interesting to see whether prices stabilise at these levels and remain supported – and if so how long for – or if they’ll drift lower again as they did following the previous cut. He did suggest that he doesn’t see US shale derailing their plans or believe forecasts that output will rise by one million barrels per day but OPEC has been wrong on this in the past.

EUR/USD – Euro Drifting Continues in Thinned Holiday Trade, Fed Minutes Disappoint

GBP Tumbles on Weakest Quarterly UK growth in More Than Four Years

Sterling has come under pressure this morning after the ONS confirmed that the UK grew by only 0.2% in the first quarter – 2% from a year earlier – which is the slowest rate of quarterly growth in more than four years.

It would appear the economic reliance on the consumer is finally taking its toll with higher prices seen as contributing to the softer activity in the first quarter. With wages now falling in real terms, this doesn’t bode well for the coming quarters and while the Brexit vote may have taken a little longer than many expected to harm the economy, it would appear that the initial pain is starting to be felt.

It’s also worth noting that the pound was already looking a little unsettled at its highs against the dollar. It would appear we’ve been seeing something of a reluctant rally over the last month and perhaps the sell-off that we’ve seen in the pair this morning is a reflection of that. Should the pair break below 1.29, it could signal a sharper downturn in the coming weeks. The weakness in the dollar – with another downturn over the last couple of weeks – is certainly helping to support the pair but with a rate hike likely at the June meeting, I wonder whether this will continue.

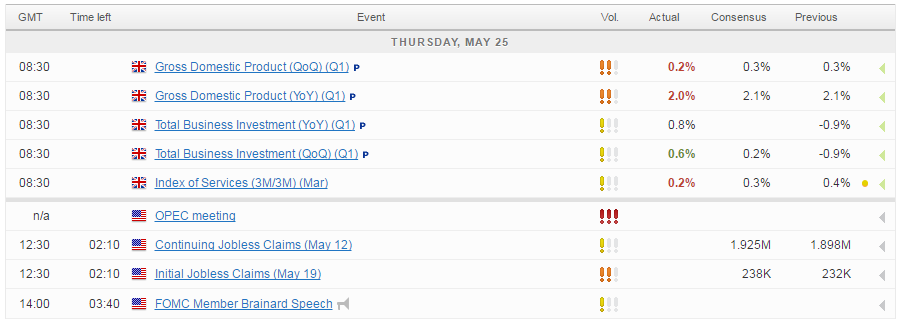

Still to come today we’ve got jobless claims data being released from the US and we’ll hear from Lael Brainard and James Bullard from the Federal Reserve.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.