European equity markets are expected to open a little higher on Monday, tracking gains throughout most of Asia and buoyed by gains in oil.

Markets boosted by Chinese stimulus plans and oil rally

We’ve seen moderate gains throughout most of Asia overnight, with the exception of Japan where earlier advances in the yen appear to have weighed on the index. While reports over the weekend of a global cyberattack and another missile launch from North Korea may have prompted some risk aversion this morning, it seems the prospect of substantial infrastructure spending from China and its commitment to free trade is taking priority.

Should we look past the US Q1 soft patch?

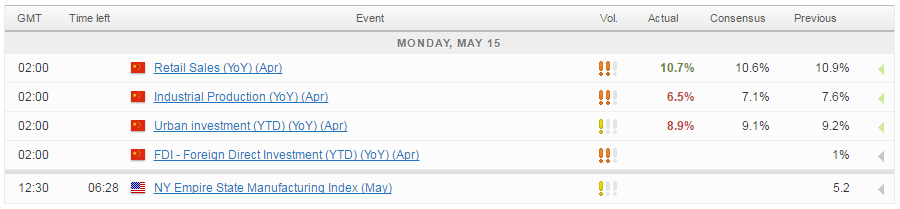

Even the softer than expected figures from China overnight are being overlooked, with retail sales, industrial production and fixed asset investment figures all falling short of expectations. Double digit growth in consumer spending remains a positive of the data, given the efforts to move away from a reliance on investment and exports.

Oil rallies as Russia and Saudi energy ministers support output cut extension

Oil prices are up more than 1.5% in early trade on Monday, boosted by reports over the weekend that energy ministers from Russia and Saudi Arabia support extending production cuts by another nine months to the end of the first quarter of next year.

OANDA fxTrade Advanced Charting Platform

The two countries – which are responsible for around a fifth of total daily output – are crucial to the success of the cut and I would now expect other participating nations to get behind the extension as well.

Week Ahead Dollar Looking to Regain Momentum

Of course, with the US taking full advantage of higher prices and increasing output rapidly at the same time, attempts to rebalance the oil market have been more difficult than anticipated. With any extension likely to keep prices elevated, it will be interesting to see whether the US can continue to ramp up production on the same scale as it has in recent months. If so, compliance with any new cut and the rebalancing efforts will be severely tested with both Russia and Saudi Arabia not wanting to lose market share in key markets.

Traders look for signs of “upside news on growth or inflation” in this week’s UK data

It’s likely to be another relatively quiet week on the data side, with the UK being a particular focus in Europe. Inflation numbers on Tuesday will be followed by the latest labour market figures on Wednesday and retail sales on Thursday, as traders look for evidence of the economy or prices rising faster than expected, given that, in the words of the Bank of England, “some MPC members would need relatively little upside news on growth or inflation to consider voting for tighter policy”. Should we see signs of this in the coming days, it could offer a boost for sterling as it moves back above 1.29 against the dollar again, with the focus very much on 1.30.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.