Caution continues to rear its head in financial markets on Wednesday and yet, a day after setting record intraday highs, US indices are poised to open a little higher once again.

Political risk remains a major concern for traders, with Donald Trump’s unpredictability, the Brexit debate in parliament and the French election all creating a rather unsettling environment for traders. We may well be seeing the Dow and Nasdaq posting new intraday highs and the S&P 500 also flirting with the idea but let’s face it, these markets are not exactly tearing higher and I don’t expect them to until some of this political toxicity begins to dissipate.

OANDA fxTrade Advanced Charting Platform

Gold has been the biggest beneficiary of this unease, trading at a three month high once again this morning despite the dollar – which is typically negatively correlated with the yellow metal – also posting gains. The dollar has been in correction mode since the start of the year but there have been signs in recent days that it is becoming attractive to buyers once again which could slow Golds ascent. A move through 101.02 in the dollar index may signify a bullish shift in momentum for the greenback, just as Gold nears its own test around $1,250. A break through here in Gold may suggest that anxiety in growing rather than abating in markets.

Oil is trading around 1% lower today after API reported a large build in inventories last week. The staggering 14.2 million barrel increase comes as OPEC and non-OPEC producers are attempting to wrestle with the market oversupply and drive prices back towards more sustainable levels. The problem these producers are now facing is that their efforts have been so successful that US shale producers that were previously priced out are now returning in large numbers. This is preventing oil getting back above $60 a barrel and instead, we’re now seeing its trading back around the lows of the range it’s held in since the start of December. The sell-off since API reported its numbers on Tuesday has been quite substantial and should EIA confirm its analysis, we could see the lower end of the ranges come under serious pressure.

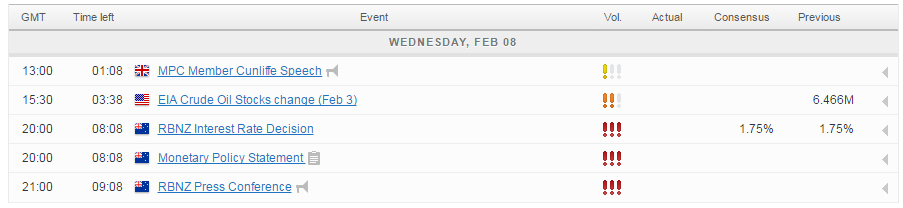

For a look at all of today’s economic events, check out our economic calendar.

For more charting analysis, check out our latest video below.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.