It may have been a slow start to the week for markets but things have certainly picked up over the last 24 hours and today is likely to be another lively session.

Donald Trump’s press conference on Wednesday was not what investors wanted to hear, with talk of protectionism and more company bashing not exactly being market friendly. That said, while we did see selling in certain areas, particularly pharmaceutical stocks, overall sentiment did improve into the end of the session and indices finished comfortably in the green. Futures currently suggest indices will open in the red today but that could rapidly change and with the Dow still flirting with 20,000, it could be a very interesting session.

USD/JPY – Yen Higher as US Dollar Falters After Trump Theatrics

We don’t just have Trump’s comments to contend with either, we’ll also get the views of half a dozen Federal Reserve policy makers throughout the day, including Chair Janet Yellen. I doubt their views will have changed too much since the December meeting given that we are none-the-wiser when it comes to Trump’s fiscal and tax plans and the data we’ve had since has been good but probably in line with their expectations.

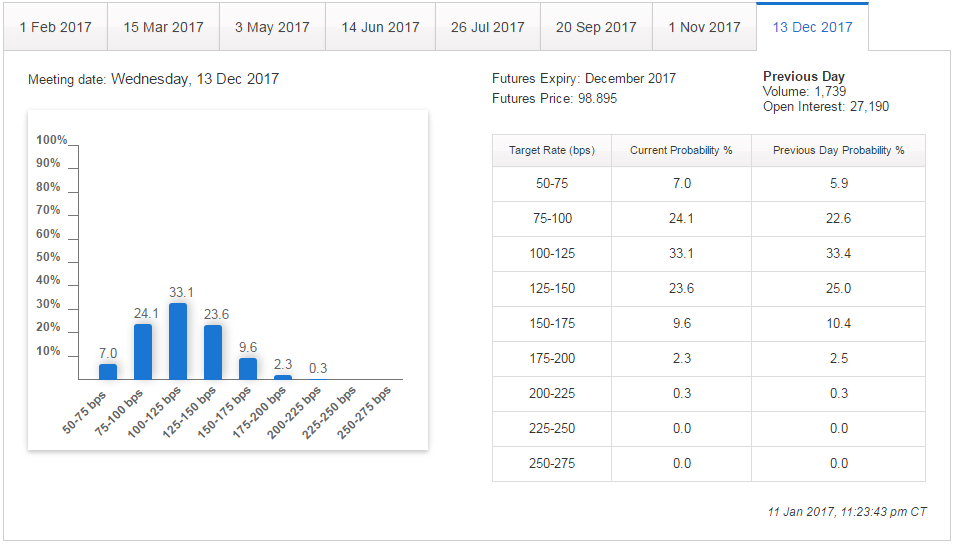

It will be interesting to see whether the Fed manages to stabilise the dollar, with the greenback having come under a lot of pressure following Trump’s comments. The outlook for interest rates will likely be heavily influenced by whether he leans towards more growth friendly stimulus measures or protectionism which could instead weigh on the economy and slow the path of hikes. I expect officials today to look beyond the recent moves and reiterate the intention to hike three times this year which could lift the dollar. Markets continue to price in only two hikes this year so remain behind the Fed on this, a tactic that proved correct last year.

Source – CME Group FedWatch Tool

Gold has broken above $1,200 today, capitalising on the weaker dollar, but it’s struggling to build on the break having run into resistance around $1,207. A hold above $1,200 would be a big psychological move with the next tests coming around $1,230 and $1,250.

OANDA fxTrade Advanced Charting Platform

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.