European equity markets are expected to open a little higher on Thursday, as investors weigh up the minutes from the December Federal Reserve meeting and eye key economic releases throughout the day.

The FOMC minutes released late on Wednesday offered some interesting insight for investors about the position of the central bank as we head into a highly uncertain year. We already had a pretty good understanding of the Fed’s position following the meeting itself, at which the central bank raised interest rates and signalled an intention to do so again three times this year. The minutes did provide a little more insight though.

To access the full FOMC minutes, click here.

I think the biggest takeaways from the minutes were that only half of policy makers had factored in fiscal stimulus into their forecasts due to the sheer lack of information on the matter, while some did raise concerns about the strength of the US dollar, which ended the year up another 4%.

All of this, combined with the significant uncertainties that remain, likely factored into the Fed reiterating that a gradual pace of tightening will likely be appropriate, which will come as a relief to investors fearing the worst. Given the uncertainties that lie ahead though, I expect it will be another volatile year in which expectations for interest rates will change on a regular basis.

APAC FX: Dollar Longs Get Squeezed

The dollar has continued to pare its gains following the release of the minutes which would suggest investors may have been expecting more focus on upside risks from the Fed. Of course, the dollar has rallied strongly in recent months so perhaps this additional insight has triggered a wave of profit taking on those moves which could lead to further dollar downside in the short term. With the dollar index having previously struggled to sustain a move above 103.80, a break below 101.90 could see it head back towards the psychologically important 100 level.

Source – Thomson Reuters Eikon

This would provide some relief for the yen which has fallen considerably during the dollar’s rise, while Gold may also be given the opportunity to make up some lost ground, with $1,200 possibly being on the horizon.

OANDA fxTrade Advanced Charting Platform

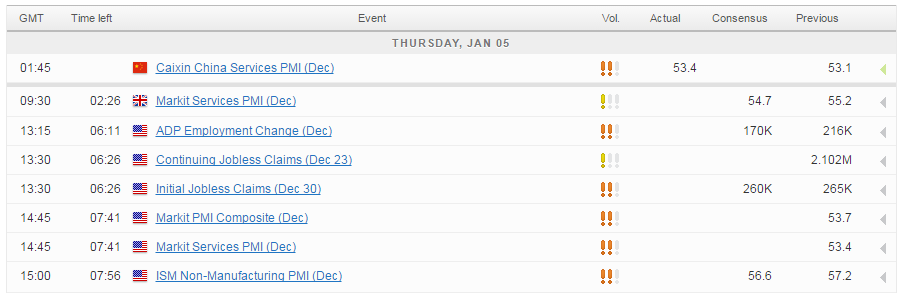

This morning we’ll get services PMI data from the UK, followed this afternoon by labour market and PMI data from the US. Oil will also be back in focus as we get the EIA crude inventory data which could provide a upside catalyst for Brent and WTI should EIA report a number in line with API’s 7.43 million barrel decline on Wednesday.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.