It would appear markets are winding down ahead of the festive period, as you would expect this time of year, with European equity markets making mild gains and US futures indicating a similar open across the pond.

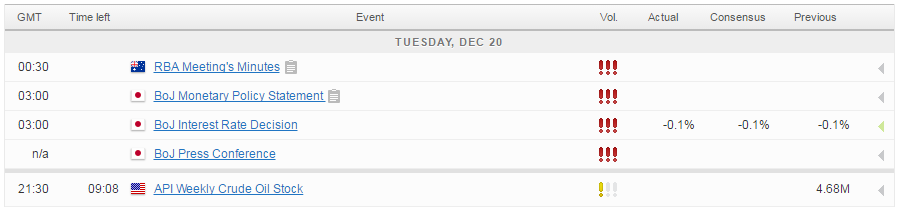

The Bank of Japan meeting overnight was probably the final scheduled noteworthy economic event of the year and passed without any real drama, with the central bank reaffirming its stance despite the recent substantial depreciation in the yen. It’s been suggested that the BoJ may look to reduce its bond purchases, raise interest rates or simply increase the target yield on 10-year bonds in order to stop the currency depreciating too rapidly but with inflation still a million miles from target, Governor Haruhiko Kuroda intimated that none of these options are currently being considered.

USD/CAD – Weak Canadian Dollar at 1.34, Wholesales Sales Next

With that being the case, the yield spread between JGBs and other countries looks set to widen over the next 12 months which is why we’re seeing the yen once again heading south today. The test for the BoJ now will be showing it’s up to any test that the market throws its way. The market has tested similar commitments on numerous occasions in the past and with Japanese yields creeping higher over the last month or so, the BoJ’s resolve may be tested soon.

Dollar Boosted by Yellen; Risk Aversion

Oil is also trading higher again today but still remains a little way off its December highs. With the output cut now agreed between OPEC and non-OPEC nations, we could now see prices stabilise around $50-55 in WTI and $53-58 in Brent. Where we go from here will depend on the implementation of the cuts which is far from guaranteed and I wouldn’t be surprised to see it hit a few stumbling blocks along the way, which could see prices plunge once again. Especially if it comes at a time when the US is once again ramping up production.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.