US futures are pointing to a higher open on Wall Street on Monday, as post-referendum woes in Italy get brushed aside and traders jump at the opportunity to buy on initial weakness.

In similar fashion to what we saw following Donald Trump’s election victory, traders this morning pounced on initial weakness in the markets and before long equity markets and the euro were both trading in the green on the day. Whether driven by complacency or reports on Friday that the ECB was ready to up its purchases of Italian debt in the event of a “no” vote, the move today would suggest that investors are not currently overly concerned about the fallout from the vote.

USD/JPY – Dollar Punches Above 114 Yen, US Services Report Next

While it may be too early to get carried away with what this means for Italy and the eurozone as a whole, Italian risk has undoubtedly increased with the banks no longer the only major threat. Italy now poses a great threat to the European project and with elections now likely to take place next year, alongside those in the other two largest economies in the eurozone, there’s likely to be a lot more talk once again of a break-up with “Itexit” this time possibly being the straw that breaks the camel’s back.

Euro Down, But Not Out After Renzi Loss

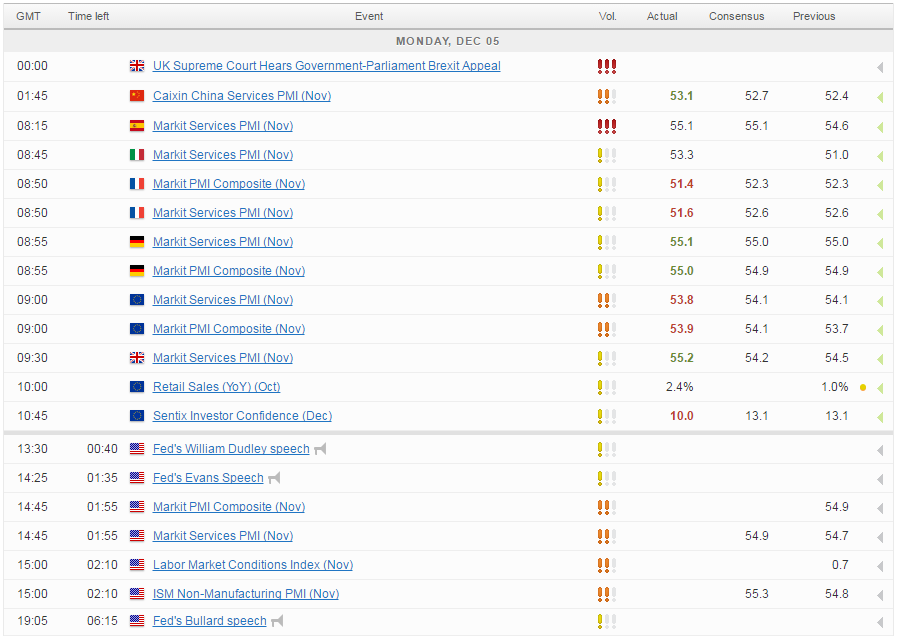

Given the events of the last couple of months, it’s quite clear that we’re back in buy the dip mode in markets despite risks growing and the Fed pursuing higher interest rates. We may not have seen the four rate hikes that the Fed intended this year but it is strongly expected to announce an increase after its meeting next week. As we head into the blackout period for the Fed, we’ll get the views of three policy makers today including William Dudley and James Bullard – both voters at the meeting next week – and Charles Evans who will become a voter for 2017.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.