The lead up to the US Presidential election was always expected to be lively but the events of the last couple of days has seriously taken its toll on investor sentiment, as is clearly evident across a number of asset classes again today.

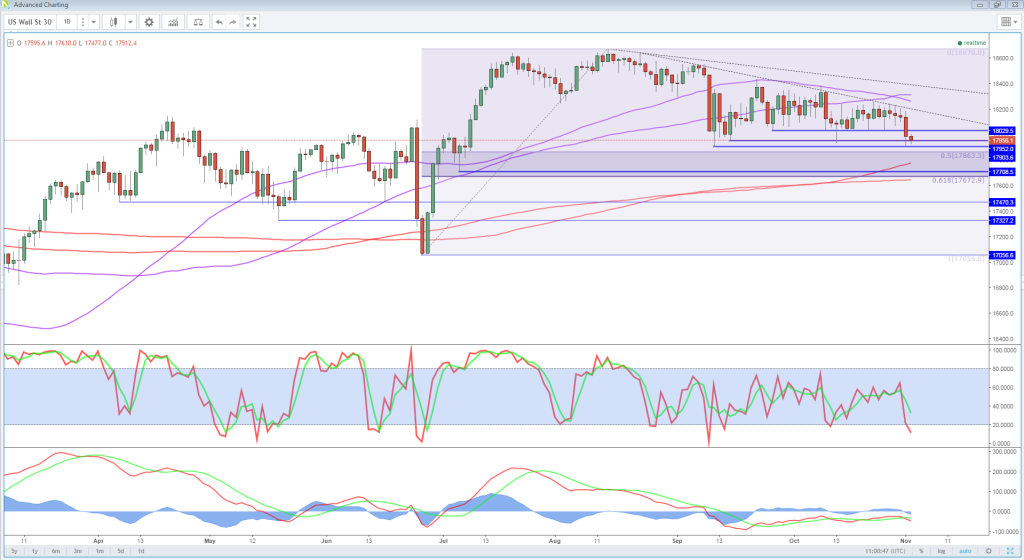

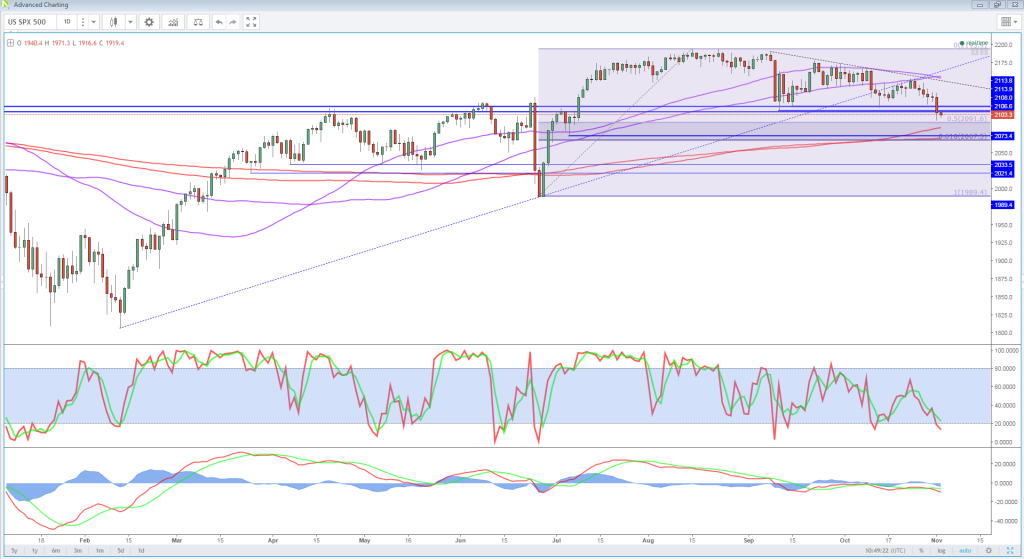

US equity markets are expected to open lower again on Wednesday, despite the Dow and S&P 500 already trading around significant technical support levels. A break of 2,100 in the S&P and 18,000 in the Dow could trigger a much more substantial move lower and as it stands, both are on course to open below these levels.

OANDA fxTrade Advanced Charting Platform

With the Fed decision and statement still to come, not to mention further election speculation throughout the day, it’s not looking great for US equities.

EUR/USD – Euro Climbs to 3-week High, FOMC Rate Announcement Next

The Fed decision itself shouldn’t cause any stress, with the market almost entirely pricing out a hike due to the proximity of the meeting to the US Presidential election and the lack of a press conference following the announcement. Should the Fed opt for a hike at the meeting, the initial market turmoil at least could be substantial, especially given how delicate they already appear to be. I think this is extremely unlikely though.

What will be interesting today is whether the Fed includes any language in its statement referencing a rate hike at the next meeting. They have clearly indicated all year that they intend to raise interest rates and in many ways, that has been stepped up in recent weeks. However, with the election outcome once again so uncertain, I wonder whether they’ll opt against any reference to the next meeting and simply reiterate the improved economic conditions. The latter could be taken by the markets that they are overpricing a hike, particularly in the event of a Trump victory.

What to Expect from the Fed Today?

Gold is on the rise again today, benefiting from its reputation as a safe haven in times of distress. Its new role as an apparent Trump hedge has seen it rally back towards $1,300 where it has currently run into some resistance. This was an important support level for Gold from June to September so it’s going to take a significant push to drive it back above here.

Oil is coming under considerable pressure also today, with the OPEC production deal looking increasingly in doubt and API reporting a substantial increase in inventories last week. Should EIA confirm this today, we could see WTI fall below $46 which could open up a move back towards $41.50-$42.50, while $45 could soon come under pressure in Brent crude.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.