As we enter the final quarter of the year, attention will remain on the usual suspects with particular focus falling on the US ahead of Friday’s jobs report release.

The year hasn’t exactly gone according to plan for the Federal Reserve, which hoped to raise interest rates four times in 2016 but is yet to back a single hike. The noises coming from within the central bank suggest one rate hike this year is still desired but in order to do so, the economic data is going to have to support it.

Sterling in the Spotlight as Asia Starts the Week

There is plenty of data being released throughout the week but as always, the bulk of the attention will be on the September jobs report. As we saw on Friday, inflation in the US continues to hover stubbornly below the Fed’s 2% target, a factor that didn’t stop them raising rates last December as job growth was strong. If we get further evidence that the economy is cooling in the coming months, there may not be the support there to raise again come December.

Of course, the Fed doesn’t just monitor a couple of pieces of data, although some will naturally carry more weight than others. PMI data is generally seen as a good barometer of how the economy is going to perform in the months ahead and when it comes to the US, the ISM release often gets the bigger response.

Week Ahead US Employment Data to Guide Market

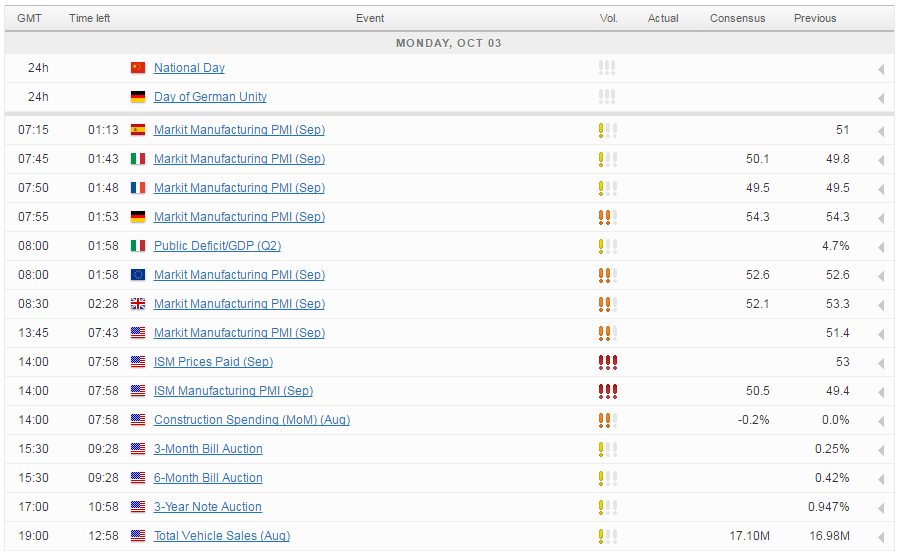

Today’s PMI reports will give us the latest insight into the manufacturing sector, not just for the US but also for the major economies in Europe as well. Markets could therefore remain quite volatile throughout the session. It is worth noting that with the bank holiday in Germany, trading volumes could be a little thin.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.