U.S. stock markets are poised to open slightly higher on Tuesday as traders eye API inventory data and a few Federal Reserve speeches throughout the session. There’ll also be an eye on the earnings season this week, which got underway on Monday with Alcoa releasing some disappointing numbers.

Brent and WTI crude are both trading higher on the session as we await the latest inventories data from API. It was this time last week that API reported an unexpected decline in oil stocks, confirmed by the EIA release on Wednesday, which sparked the week-long rally that is still going on today. This week oil traders will primarily be focused on the meeting of oil producers in Doha, but another drawdown today could spur another rally in the meantime.

The meeting on Sunday comprises of producers of around three quarters of global output and if a deal is agreed on a production freeze or even a cut, the latter of which is very unlikely, it could be the catalyst that drives the next rally in oil and take it back above $50 for the first time since November. There are a lot of obstacles to such a deal being done though, not least Iran’s determination to return to pre-sanctions production levels, which makes me sceptical that it can be achieved.

We have some more Fed officials speaking on Tuesday, although it’s worth noting that none of those scheduled are voting members on the FOMC this year. Jeffrey Lacker, John Williams and Patrick Harker are all scheduled to speak today and could offer some insight into how close the Fed is to building a consensus on the timing of the next rate hike given that we are now seeing higher levels of inflation – albeit still below target – and unemployment is very low at 5%.

U.K. inflation data out this morning gave a boost to the pound, coming in higher than expected and rising to a 15-month high on the back of rising air fares and clothing prices. While this could be a positive early sign of higher levels of inflation to come, it is still only one reading and we’ll need to see more sustainable higher levels of inflation in the coming months before investors potentially start considering the prospect of rising interest rates in the U.K. The Bank of England remains well below target at this stage and the move back towards it is likely to remain very slow, regardless of this month’s spike.

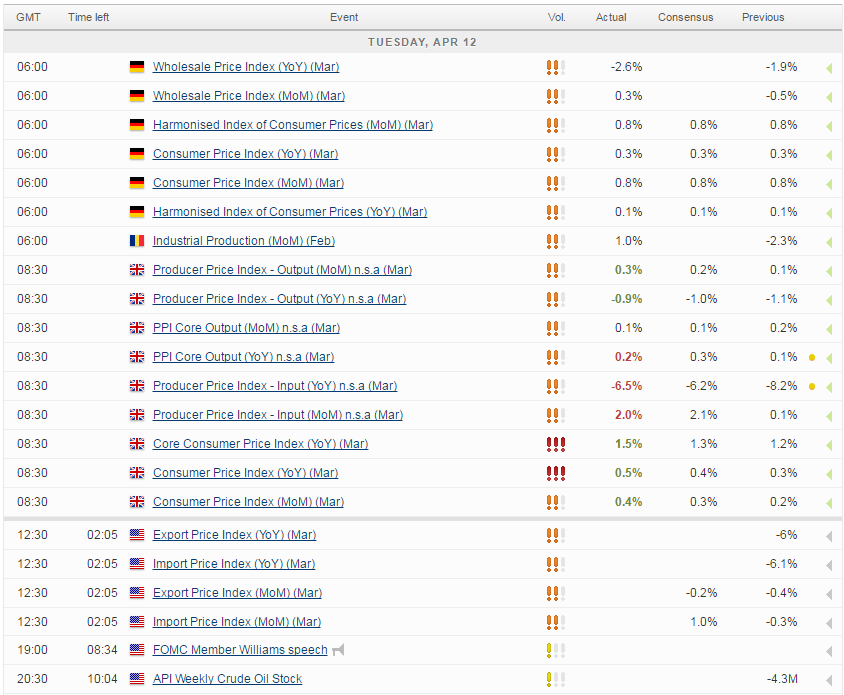

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.