The European session is set for a positive open on Wednesday, buoyed by a rebound in oil prices overnight and some encouraging data from China.

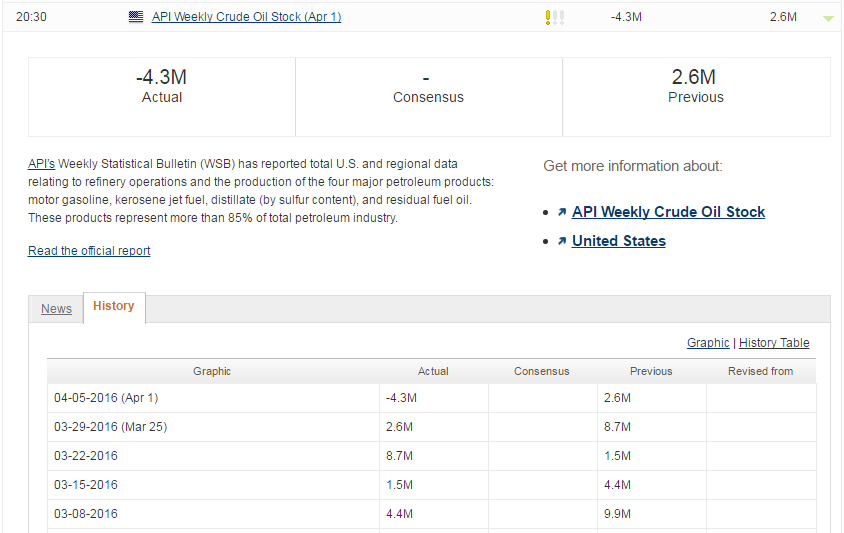

Oil has been under pressure over the last couple of weeks, coming off its 2016 highs as talks on an output freeze between OPEC and Russia appear to have stalled. Prices were given a boost overnight though as API reported that stocks fell by 4.3 million last week, despite expectations of a similar build which suggests we could be in for a surprise when EIA releases its figures this evening.

While this is provided a boost today though, I do think this could just be temporary with any sustained rally hanging on OPEC at least agreeing to freeze output and beyond that, any sustainable move higher relying on production cuts.

The Chinese services PMI also bounced back in March, rising to 52.2 after slipping to 51.2 in February. The services sector is becoming increasingly important for the Chinese economy, as the country continues its transition towards domestic consumption and reduces its reliance on investment and manufacturing. Of course, not everything in the report was positive – employment sub-index contracted for the first time since August 2013 – and these numbers remain quite volatile from month to month which highlights the difficulties the country is facing to successfully carry out this transformation in the economy.

The latest Caixin Services PMI report can be found here.

APAC Currency Corner – Equity Markets Sour

The European session is looking relatively quiet on Wednesday, with German industrial production figures the only notable event this morning. Industrial output is expected to have declined by 1.8% in February, which is consistent with the disappointing report on factory orders that was released on Tuesday that showed a surprise 1.2% from January. The numbers highlight the challenging environment manufacturers continue to face with demand in the euro area remaining subdued and slowing growth in emerging markets not helping matters.

The key event today will be the release of the FOMC minutes this evening. The minutes are from the March meeting and will offer additional insight into the Federal Reserve’s position on interest rates given its sudden change of heart on the number of hikes this year. The Fed cut its rate hike forecasts for this year from four to two last month and a rise this month looks all but off the table. Comments from Fed officials recently have been very mixed, reflecting the clear lack of consensus on the committee which makes the prospect of a hike in the short term seem very unlikely, especially with Chair Janet Yellen sitting firmly in the dovish camp. We will also hear from Fed members Loretta Mester and James Bullard this evening as they offer their latest views on the U.S. economy and potentially give their insight into the correct path for interest rates this year.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.