All eyes will be on the ECB on Thursday as President Mario Draghi attempts to avoid the mistakes of the past and deliver on a monetary easing package that is worthy of driving inflation back towards its target of below but close to 2%. While this is no easy task, as central banks all over the world would agree, it is clear that more needs to be done with core inflation in the euro area currently well below target at 0.7%.

What makes this meeting particularly interesting is that due to the rotation of voting rights in the governing council, Bundesbank Head and well known hawk Jens Weidmann will not have a vote at today’s meeting.

The full list of voting rights can be found on the ECB website.

This could therefore be Draghi’s best opportunity to gather the necessary support to unleash the bazooka, having failed to do so in December.

In the build up to that meeting, Draghi in particular, talked up the prospect of a significant stimulus package only to dramatically under deliver. While policy makers have been careful not to over promise ahead of this meeting, it is clear that many, including Draghi himself, believe bold action is needed. In the absence of the usual Weidmann opposition, the ECB may finally be able to do what it failed to in December, deliver a substantial stimulus package that the markets can get on board with.

Another failure to do so could be seen as a sign that the ECB is running out of viable options and its ability to achieve its sole mandate of price stability will come under question. We are already in uncharted territory – quantitative easing, negative interest rates – if the risks of delving deeper into either are perceived to be greater than not then the ECB has a real problem on its hands.

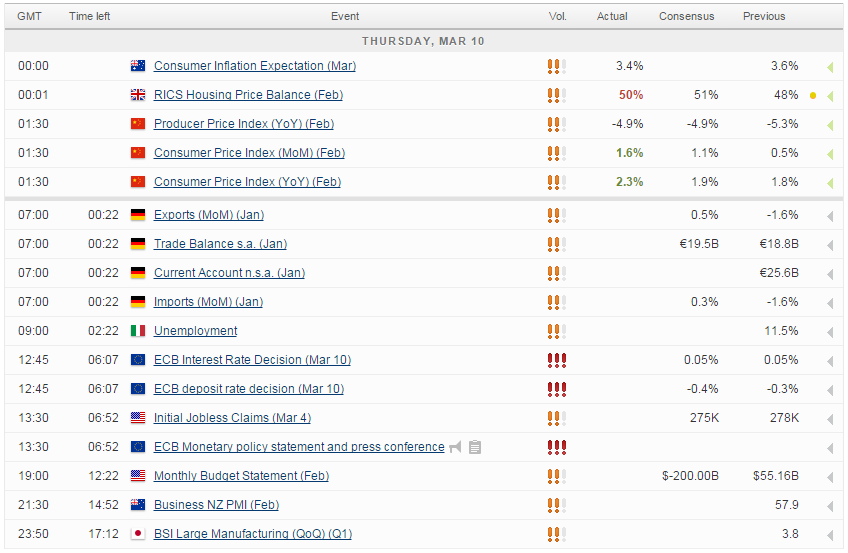

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.